Vivo Takes the Crown, Samsung Stumbles, and Apple Quietly Wins Big in India’s Smartphone Battle

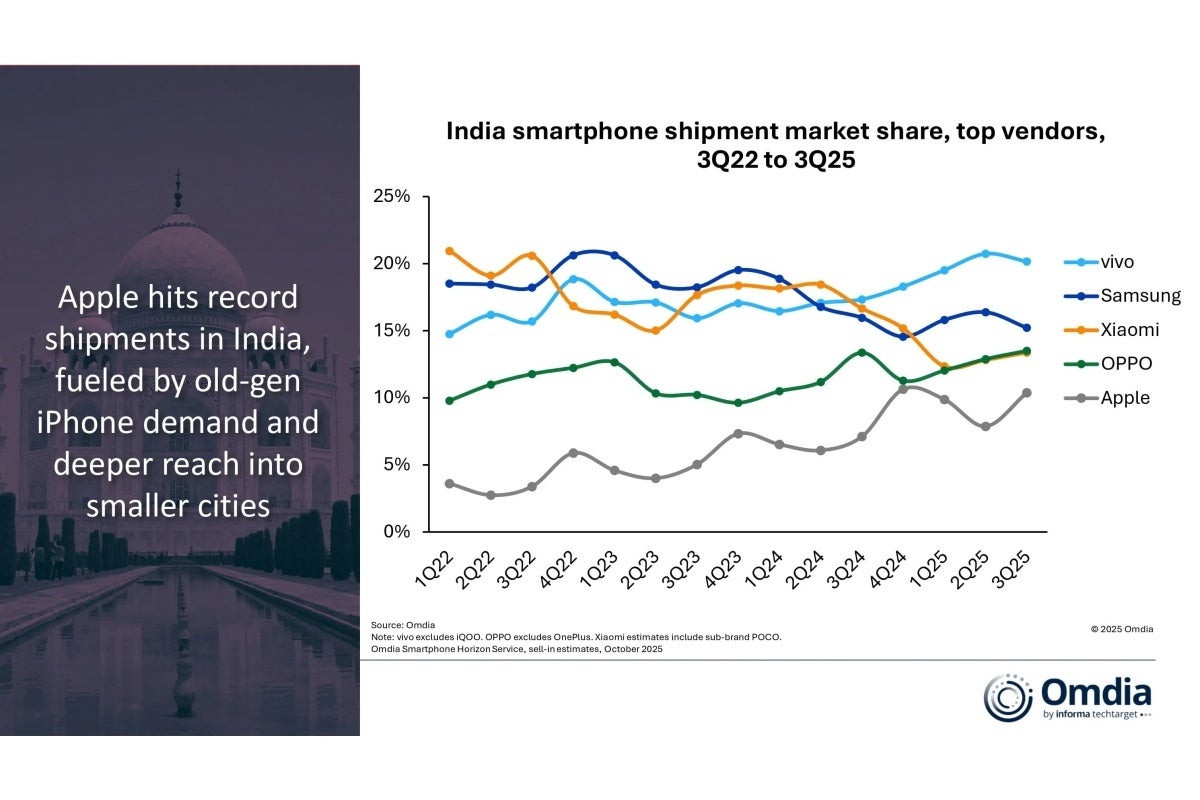

The Indian smartphone market, one of the most competitive and fast-evolving in the world, has just seen a remarkable quarter. Between July and September 2025, approximately 48.4 million smartphones were shipped across the country. The numbers tell a fascinating story: Vivo now leads the race with a 20% market share, Samsung trails behind at 14%, and Apple, despite holding only 10%, is celebrating one of its best quarters ever in India. On paper, Apple’s slice may look modest – but the story beneath the surface reveals a very different picture of success.

At first glance, 10% doesn’t sound like a winning figure. But when it comes to long-term strategy, Apple’s performance in India represents something far more significant than temporary market share dominance. According to Omdia’s latest India smartphone market report, Apple’s year-on-year growth outpaces nearly every other major brand. The Cupertino giant saw a staggering 47% jump compared to the same quarter last year, soaring from 3.3 million to 4.9 million units sold. Meanwhile, Samsung’s shipments dropped 9%, falling from 7.5 million to around 6.8 million devices. In a market as price-sensitive as India, that contrast says a lot.

Vivo may hold the top spot, but its growth – though solid at 19% year-on-year – is far less explosive than Apple’s surge. Other brands like Motorola and Nothing also saw massive spikes of 53% and 66% respectively, suggesting that Indian consumers are increasingly willing to experiment with different brands offering high value for money. Still, Apple’s ability to grow faster than almost everyone else in a market once considered impenetrable for its premium devices shows how dramatically the game has changed.

Will Apple finally take the crown in Q4 2025? That’s the million-dollar question. Globally, Apple’s chances look strong, but in India, the competition is fiercer than ever. Vivo, Xiaomi, Samsung, and Oppo have traditionally dominated the final quarter of the year, riding on aggressive holiday promotions and deep retail networks. Last year, Apple barely cracked the top five in India’s Q4 rankings for the first time ever. But this year, it’s back stronger than before, with iPhone sales hitting new records. Even if it doesn’t claim the top spot, Apple’s performance reflects an undeniable momentum.

Much of Apple’s success can be attributed to its broader product strategy. The company has found a winning formula in balancing older, more affordable iPhones with its latest flagships. The iPhone 15 and iPhone 16 series continue to drive volume in India, offering aspirational users a taste of Apple’s ecosystem at relatively lower prices. Meanwhile, the base iPhone 17 model is off to an impressive start, appealing to both first-time buyers and those upgrading from older Android phones. The premium iPhone 17 Pro and Pro Max are gaining slower traction, reflecting the continued price sensitivity of Indian consumers.

Samsung, by contrast, seems to be struggling to maintain its once-unshakable hold on the market. Its midrange Galaxy A-series, once a favorite among Indian buyers, has lost momentum, while the high-end Galaxy S25 series hasn’t been able to ignite the same excitement as Apple’s latest flagships. Even the Galaxy S24 FE and S25 FE, despite being strong budget-friendly performers, haven’t compensated for weaker sales in other segments. The company’s challenge appears to lie in refreshing its strategy to better appeal to consumers who now have more options than ever before.

Vivo, on the other hand, has mastered the art of market diversity. Its strength lies in its balanced portfolio and highly localized retail strategies. By targeting multiple price tiers and leveraging aggressive offline marketing, Vivo has managed to appeal to both entry-level buyers and midrange users alike. It’s this approach – diversity and accessibility – that’s allowed it to stay ahead, at least for now.

Despite these impressive individual performances, India’s smartphone market as a whole is showing signs of fatigue. While shipments rose slightly – up 3% from Q3 2024 – analysts warn that Q4 might not continue the trend. After a weak first quarter and a modest rebound midyear, there’s concern that full-year results could end in a small overall decline. The market’s maturity means that new growth will depend on innovation, 5G adoption, and competitive pricing rather than mere volume expansion.

The new rule of success: diversity and balance

Omdia’s report makes it clear that the future belongs to brands that can diversify effectively. Apple’s progress shows how a once ultra-premium brand can adapt to emerging markets without losing its identity. Motorola’s record-breaking quarter, powered by the popular Moto G and Edge 60 series, highlights how a focused, balanced lineup can reignite consumer interest. Even Nothing’s bold growth, driven by design-focused midrange phones, reinforces that consumers crave something fresh and authentic.

Ultimately, India’s smartphone market no longer rewards a single strategy. Whether it’s Apple’s ecosystem-driven expansion, Vivo’s localized retail tactics, or Motorola’s product consistency, success now demands flexibility and understanding of regional tastes. The message from Q3 2025 is loud and clear: dominance in India’s smartphone arena isn’t just about shipping millions – it’s about reading the pulse of a diverse, ever-evolving audience.

2 comments

Vivo plays the offline game perfectly. Smart strategy

Honestly surprised Motorola’s doing that well, I thought they were dead!