The global semiconductor market has always been a fiercely competitive arena, with some companies carving out a dominant position over the years. TSMC (Taiwan Semiconductor Manufacturing Company) is currently leading the pack, and its latest quarterly performance is a testament to its growing dominance in the industry.

According to the most recent figures, for the second quarter of 2025, TSMC’s market share surged past 70%, marking an impressive milestone in its long-standing leadership.

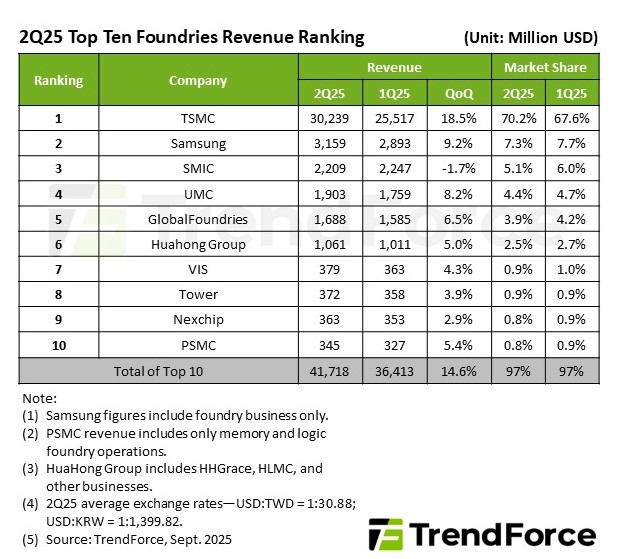

During Q2 2025, TSMC’s revenue share hit an impressive 70.2%, a noticeable increase from 67.6% in Q1 2025. This surge was not merely due to an isolated factor but a combination of several elements driving the market’s growth. The entire semiconductor sector experienced a significant revenue boost of 14.6% compared to the previous quarter. Much of this growth can be attributed to national subsidies, which have helped bolster the industry’s output, as well as increased demand from major sectors such as smartphones, artificial intelligence (AI), personal computers (PCs), and servers.

In raw figures, TSMC’s revenue for Q2 2025 reached an astounding $30.239 billion, a sharp rise from the previous quarter’s $25.517 billion. This represents an 18.5% increase in quarterly revenue, a remarkable achievement for a company already at the forefront of semiconductor manufacturing. However, while TSMC was seeing a rise, its closest competitor, Samsung, faced a slight dip in market share. Samsung’s market share fell from 7.7% in Q1 2025 to 7.3% in Q2, despite a 9.2% revenue gain, which saw it generating $3.159 billion in Q2 2025.

The future looks even brighter for TSMC, with predictions suggesting that its market share could rise to an impressive 75% in 2026. This anticipated growth is largely due to the company’s upcoming mass production of 2nm wafers, which are expected to meet the increasing demand for cutting-edge chips across various industries. In fact, TSMC plans to begin mass production of these 2nm chips by the fourth quarter of 2025

. Apple, as expected, has already secured a large portion of these chips, but orders from other major players like Qualcomm, MediaTek, and Broadcom are also expected to contribute significantly to TSMC’s growth.

To maintain its edge in the semiconductor race, TSMC is not resting on its laurels. The company is reportedly investing heavily in the construction of a new manufacturing facility in Taiwan, which will be dedicated to producing chips at the 1.4nm node. This next-generation facility is expected to receive an initial investment of a staggering $49 billion, further cementing TSMC’s commitment to maintaining its technological lead.

Despite TSMC’s dominance, Samsung is far from out of the game. The South Korean giant is working on its 2nm Gate-All-Around (GAA) process, with plans to release its Exynos 2600 chipset, which will be one of the first to utilize this cutting-edge technology. Samsung’s launch of the Exynos 2600 will allow it to compete directly with TSMC’s 2nm offerings, and if successful, it could be a major milestone in the ongoing battle for semiconductor supremacy.

In conclusion, TSMC’s current market share of over 70% demonstrates the company’s unrivaled position in the semiconductor industry. With ambitious plans for the future, including the mass production of 2nm chips and the construction of a state-of-the-art 1.4nm facility, TSMC is on track to further extend its dominance in the coming years. However, Samsung’s own advancements with its 2nm GAA process ensure that the competition remains fierce, setting the stage for an exciting future in semiconductor technology.

4 comments

Yo, TSMC is absolutely dominating right now, wonder how long they can keep this up 🤔

TSMC really killing it with those 2nm wafers, I bet Apple is behind most of those orders lol

49 billion for that 1.4nm facility?? TSMC is crazy rich 😳

Lol Samsung needs to step up its game, 7.3% ain’t cutting it 😅