A senior figure from TSMC’s inner circle, Dr. Wei-Jen Lo, is reportedly preparing to take a leading role at Intel, and the move is already shaking the semiconductor world.

On paper, it looks like just another high-profile hire in a brutally competitive industry. In reality, it sits at the intersection of trade-secret law, national industrial strategy, and a heated online argument over who is really stealing whose technology.

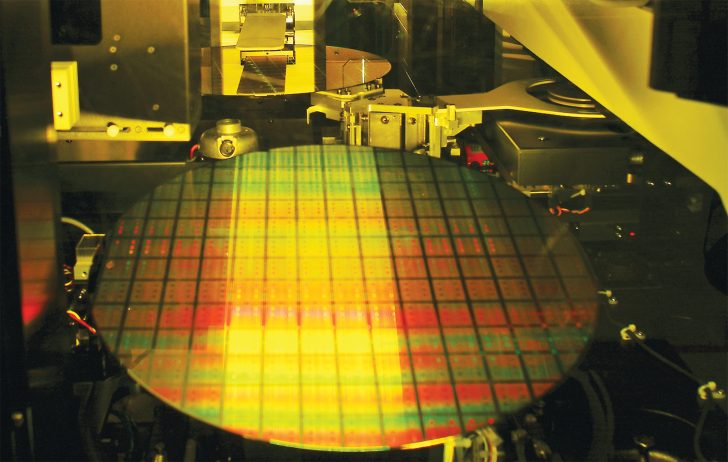

Lo spent close to two decades at Taiwan Semiconductor Manufacturing Company, helping build the playbook that turned TSMC into the world’s most advanced contract chipmaker. He was deeply involved in the rollout of extreme ultraviolet lithography and in laying the groundwork for the company’s next-generation process nodes, including 2 nm and even more aggressive 1.6 nm class technology. In other words, he does not just know the roadmap; he helped write it, from device structures and materials choices to yield-improvement tactics that never show up in glossy marketing slides.

That is why reports from Taiwanese media that TSMC is considering legal action have drawn so much attention. According to those reports, the company is assessing whether Lo’s move to Intel could violate Taiwan’s Trade Secrets Act. The concern is not the sort of general industry knowledge that any senior engineer or executive naturally carries in their head when they change jobs. The spotlight is on Lo’s long-standing habit of taking extensive handwritten notes during highly confidential internal meetings.

Sources in Taiwan claim that when Lo left TSMC he packed those handwritten materials into several boxes and took them with him. On their own, notebooks are not proof of wrongdoing, and there is no public evidence that any proprietary data has been passed to Intel. Still, the optics are explosive. If those notes capture details on 2 nm or 1.6 nm process integration, transistor design tweaks, yield-learning playbooks, or the way TSMC structures its engineering task forces, they could in theory give a rival foundry an enormous shortcut.

It is exactly this scenario that has fueled speculation that Intel could secure a massive advantage if the hire goes through. Intel Foundry is racing to regain technological leadership after years of delay, while TSMC and Samsung have pulled ahead on advanced nodes. Bringing in a veteran who understands TSMC’s internal culture, risk-taking philosophy, and problem-solving frameworks could be just as valuable as any single technical document. The value is not just in individual secrets, but in knowing which ideas TSMC tried and abandoned, which experiments quietly worked, and how the company reacts when timelines slip.

Online, the story has already morphed into a broader argument about double standards. For years, Western politicians and commentators have framed intellectual-property theft as something that China does, pointing fingers at mainland firms and warning about spies in lab coats. Now critics point out that a flagship US-aligned company is trying to hire away a key architect of TSMC’s 2 nm program, allegedly with boxes of notes from sensitive meetings somewhere in the background. To them, it looks less like moral high ground and more like great-power realpolitik dressed up in corporate press releases.

Others take aim directly at Intel, reviving the old Shintel nickname and accusing the company, at least emotionally, of leaning on poaching and legal grey areas instead of winning purely on engineering execution. That view is drenched in memes, sarcasm, and the usual forum trolling, but it taps into a real frustration. Enthusiasts want genuine competition between chipmakers, not a tech cold war fought through export control lists, back-room diplomatic pressure, and talent raids that blur the line between normal hiring and strategic extraction of know-how.

TSMC, for its part, cannot simply shrug and move on. Advanced process technology is the crown jewel of Taiwan’s economy and a pillar of the island’s geopolitical leverage. If the firm concludes that any trade secrets have been compromised, it could pursue civil claims, request a criminal investigation, or quietly lean on regulators and diplomats to step in. At the same time, it has to be careful not to send the message that any senior engineer who changes jobs will automatically be treated as a suspect, which could chill talent mobility and backfire over the long run.

For Intel, the stakes are just as high but of a different kind. The company is betting its future on becoming a competitive global foundry, opening its fabs to external customers while still serving its own CPU and GPU lines. A seasoned leader like Lo could help restructure Intel Foundry’s internal processes, streamline decision-making, and inject some of the fast-moving, night-shift task-force mentality that reportedly made TSMC’s secretive Nighthawk teams so effective at solving urgent yield problems.

Behind the legal language and diplomatic maneuvering lies a simple truth: the race to 2 nm and beyond is no longer just about bragging rights on transistor density charts. These nodes underpin data-center AI accelerators, flagship smartphones, next-generation networking gear, and cutting-edge military and communication systems. Whoever controls them gains not only huge commercial power but also strategic leverage in a world where silicon is becoming as critical to national strength as oil once was.

For now, the case remains in limbo. TSMC is said to be weighing its legal options, Intel has kept quiet in public, and no formal charges have surfaced. Until investigators determine what, exactly, sits inside those boxes of handwritten notes and how they have been used, everything else is speculation. But the controversy already shows how fragile trust has become in the semiconductor supply chain, and how, in this high-stakes game, even a few notebooks can look like potential weapons.