Taiwan has firmly dismissed Washington’s suggestion that it shift half of its semiconductor production capacity to the United States, a proposal that has sparked heated political and economic debate on both sides of the Pacific. The idea, raised by U.S.

Commerce Secretary Howard Lutnick, reflects deep anxiety within the Trump-era administration about America’s heavy dependence on Taiwan for the chips that drive everything from iPhones to AI servers. But for Taipei, such a move would not only damage its economy but also undermine what many see as its most critical strategic asset – the so-called ‘Silicon Shield.’

U.S. concerns over chip dependence

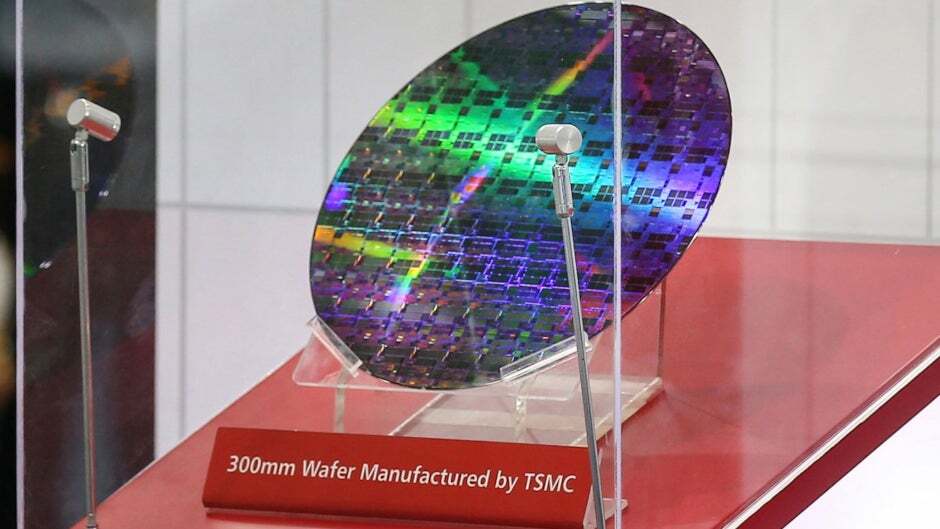

The United States currently sources roughly 95% of its advanced chip demand from Taiwan, almost entirely through TSMC, the world’s largest contract semiconductor manufacturer. TSMC is responsible for producing cutting-edge chips that power Apple’s iPhones, NVIDIA’s graphics processors, and Qualcomm’s mobile platforms. This reliance has made U.S. officials uneasy, especially in the face of global supply chain disruptions and growing tensions with China, which views Taiwan as part of its territory.

Lutnick floated the idea of a “50-50 split” in semiconductor production between Taiwan and the U.S., telling reporters that it was vital to bring half of TSMC’s capacity stateside. “The idea I pitched them was: let’s get to 50-50. We produce half, you produce half,” he explained, presenting it as a safeguard against future shortages and geopolitical risks.

Taiwan’s sharp rejection

However, Taiwan’s Vice Premier Cheng Li-chiun was quick to quash the notion, clarifying that no such proposal had been formally discussed in trade talks. Instead, the focus of bilateral negotiations had been on tariffs and exemptions from “tariff stacking,” a costly burden when goods are hit with multiple duties as they cross different borders during production. Speaking at Taoyuan International Airport, Cheng reassured the public that Taiwan had not made any commitments to split chip production. “Our negotiating team has never made such a promise, so the public can rest assured,” she said.

The rejection resonated strongly within Taiwan’s political class. Eric Chou, leader of the Kuomintang opposition party, blasted the U.S. proposal as “exploitation and plunder,” insisting that no one had the right to undermine Taiwan’s most valuable economic and strategic lifeline.

The Silicon Shield: protection through indispensability

The outrage stems largely from the importance of the “Silicon Shield” theory. This concept suggests that Taiwan’s dominance in advanced chip manufacturing makes the island indispensable to global powers, particularly the U.S., Europe, and Japan. As long as these economies rely on Taiwan’s output, they are seen as more likely to intervene if Beijing were to attempt an invasion. Sacrificing a large share of chip production to the U.S., many argue, could weaken this de facto deterrent.

Rumors have long swirled that TSMC has contingency plans in case of invasion, including the possibility of disabling or even destroying critical infrastructure like cleanrooms – essential for chip production – to ensure that fabs could not be seized intact by China. Though unconfirmed, such a scorched-earth policy reflects the high-stakes environment surrounding Taiwan’s semiconductor dominance.

Experts warn of harm to Taiwan’s ecosystem

Analysts in Taiwan warn that meeting Washington’s demand would destabilize the local economy. Arisa Liu, an economist at the Taiwan Institute of Economic Research, argued that shifting massive production capacity abroad would inevitably damage Taiwan’s semiconductor ecosystem. “It brings more harm than benefit to Taiwan,” she told CNN, warning that supply chain integrity would be undermined by such an exodus.

U.S. efforts to build chip independence

Although the 50-50 split proposal has been firmly rejected, Washington has scored some wins in reducing dependence. Under former President Donald Trump, TSMC agreed to establish fabrication facilities in Phoenix, Arizona – a significant symbolic victory for the U.S. semiconductor sector. The Biden administration followed up by passing the CHIPS and Science Act in 2022, offering $52.7 billion in subsidies and tax incentives to encourage domestic manufacturing.

TSMC itself has already committed $65 billion to multiple U.S. fabs, with the first Arizona facility producing 4nm chips. By 2028 or 2029, the company expects to begin mass production of 2nm chips in the U.S., an achievement that would have seemed unrealistic just a decade ago. While such investments will not erase America’s reliance on Taiwan overnight, they do signal a gradual diversification of global chipmaking power.

A balancing act between security and sovereignty

At the heart of the dispute is a clash of priorities: the U.S. desire for supply chain security versus Taiwan’s determination to preserve its strategic leverage. For Washington, moving production is about reducing national vulnerability in a world increasingly defined by tech competition and geopolitical uncertainty. For Taipei, holding onto its near-monopoly in advanced chipmaking is about survival, ensuring that allies remain invested in its defense.

For now, Taiwan’s message remains clear: TSMC’s fabs are not up for negotiation. The Silicon Shield remains intact, and Taiwan intends to keep it that way.

3 comments

wow didnt kno TSMC already building 2nm fabs in US, thats crazy

US tryna bully smaller countries again smh

makes sense, Taiwan needs that silicon shield more than ever