The PC graphics market is finally breathing again. After several choppy quarters, Q3 2025 brought a modest but meaningful rebound for both GPUs and CPUs.

Fresh data from Jon Peddie Research shows that shipments are ticking up and, more importantly, the balance of power between Intel, NVIDIA and AMD is shifting in slow motion. The headline percentages look small on paper, but behind them sits a story about changing buyer habits, the tug of war between gaming and AI, and a fanbase that never gets tired of arguing over who is winning.

According to the latest report, total PC GPU shipments reached 76.6 million units in Q3 2025. That is a 2.5 percent increase over the previous quarter and roughly 4.0 percent more than the same period a year earlier. Discrete graphics cards led the rebound with a strong 10.7 percent year over year jump, while notebook GPUs grew a quieter 1.4 percent. On the CPU side, the market shipped around 65 million units. Shipments rose 2.2 percent quarter over quarter, even though overall PC CPU volumes are still down about 2.2 percent compared to Q3 2024 as the industry continues to work through the hangover from the pandemic boom.

One of the most eye catching data points is the GPU attach rate in PCs, which climbed to 120 percent this quarter, up 2.9 percent versus Q2. In plain language, there are now more GPUs than CPUs in the installed base, because a single system can carry multiple graphics processors. A typical notebook or desktop might rely on integrated graphics inside the CPU and also have a discrete card, while some workstations and enthusiast rigs pair more than one dedicated GPU. It is the kind of nuance that almost never shows up in forum flame wars, yet it helps explain why the charts do not always match what people think they see in their local gaming cafe.

GPU market share: Intel huge overall, NVIDIA rules gaming, AMD nudges upward

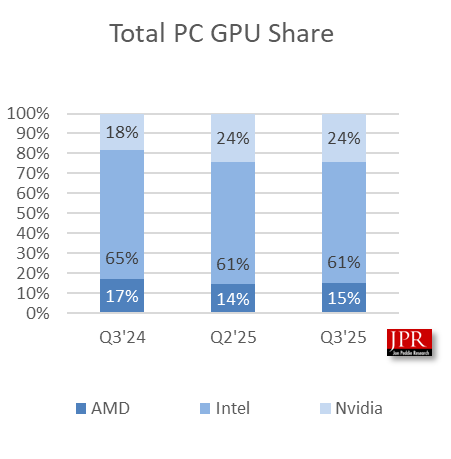

In the broad GPU market that counts every integrated, discrete and external unit, Intel still sits in first place by a wide margin. Its vast fleet of integrated GPUs gives it around 61 percent share. NVIDIA holds second place at roughly 24 percent, while AMD sits in third at 15 percent. Those figures roll together everything from slim office notebooks to chunky workstations and gaming desktops, so they tell a very different story from the narrow gaming charts that fans often quote.

Quarter to quarter, though, the picture becomes more interesting. In Q3 2025, AMD managed to grow its overall GPU share by about 0.9 percentage points compared with Q2. NVIDIA slipped by around 0.1 points and Intel ceded close to 0.9 points. In absolute terms that movement is small, but when each percentage point represents millions of units it is enough to give AMD supporters a talking point and to remind Intel that integrated dominance is not guaranteed forever. Look at the yearly trajectory and NVIDIA emerges as the biggest climber, rising from 18 percent in Q3 2024 to 24 percent in Q3 2025, while Intel slides from 65 percent to 61 percent and AMD moves from 17 percent down to 15 percent.

That year over year decline for AMD is why some readers glance at the tables and conclude that the company lost, even though it gained share compared with the previous quarter. A lot depends on which time frame you choose and whether you are looking at the total GPU universe or only at dedicated gaming cards. In the discrete segment, NVIDIA still operates in near monopoly territory, controlling around 94 percent of the market, with AMD at roughly 6 percent and Intel effectively at zero for this quarter. That reality matches the anecdotal feeling many gamers share when they say they rarely encounter Radeon cards in the wild, even though AMD clearly ships millions of GPUs into the wider PC ecosystem.

CPUs: AMD slowly taking bites out of Intel

The CPU side of the report tells a related but calmer story. Total PC CPU shipments climbed 2.2 percent versus the previous quarter, yet remained 2.2 percent below Q3 2024, underlining how the upgrade cycle is still normalising after the extreme highs and lows of recent years. The split between form factors has barely moved: desktop processors account for around 30 percent of the market, while notebook CPUs dominate with roughly 70 percent share. That alone explains why so many GPUs counted in these statistics end up inside corporate fleets and productivity laptops rather than in tempered glass gaming towers.

Inside that market, AMD continues the slow work of eroding Intel’s long held lead. In Q3 2025, AMD added about 1 percentage point of CPU share, while Intel lost around 0.8 points. It is hardly a collapse, but it is enough to fuel the constant jokes about the downfall of Intel that appear every time new numbers land. The reality is much less dramatic. Intel still ships the majority of PC processors and integrated GPUs, but the trend line over multiple years is a gentle slope downward, while AMD’s line points upward as more consumers and businesses become comfortable picking systems built around Ryzen.

What the community gets right and wrong

If you only listened to the loudest voices online, you might believe Intel buyers are clueless, Radeon is on its last leg and NVIDIA is driven purely by greed. The data paints a more nuanced picture. Intel is clearly losing ground, but from a huge base. NVIDIA dominates discrete gaming not by accident but through years of strong branding, mature software and a willingness from players to pay premium prices, even when mid range cards from both companies are constantly discounted. At the same time, that 94 percent share in discrete means NVIDIA can afford to be confident on pricing, which is exactly what frustrates many PC enthusiasts.

AMD sits in a complicated middle position. On the CPU front it is competitive and often preferred by power users. On the GPU front it is clearly not chasing every last percentage point of gaming share at any cost. Many observers point out that AMD’s management seems more focused on AI accelerators and data center chips, where margins are higher and demand is exploding. From a business perspective that makes sense, but it also means gaming GPUs sometimes feel like a side quest rather than the main mission. Community veterans argue that AMD could quickly expand its graphics share if it accepted lower margins for a couple of generations, kept a consistent naming scheme and launched an uncompromising halo flagship every cycle instead of skipping the very top tier.

In parallel, AMD’s engineers are investing heavily in chiplet and multi die approaches that mirror what the company already does in Ryzen, Threadripper and Epyc. Fully exploiting multi chip module designs in future Radeon architectures could let AMD scale performance by adding more small tiles to a single package instead of betting on one giant monolithic die that fights for the same foundry capacity as CPUs and AI accelerators. Enthusiasts are already speculating about what that first truly modular gaming GPU generation might look like and how it would change the competitive landscape.

Looking ahead to Q4 2025 and the 2026 lineups

All of this is happening in what feels like a calm before the storm. None of the three vendors launched a brand new PC GPU in Q3 2025, and the CPU side saw little real action either. The upcoming deals season is likely to reshuffle shipment figures again in Q4 as retailers cut prices on current GeForce, Radeon and Arc cards and as OEMs clear out older notebook and desktop inventory. For many buyers in the mid range, a sharp discount still matters more than which logo moved up or down by 0.9 percent in an analyst chart.

The bigger reset will arrive in the first half of 2026, when NVIDIA, AMD and Intel are expected to roll out their next major GPU and CPU families. That is when we will see whether AMD leans even harder into AI first and gaming second, whether Intel can convert its integrated graphics footprint into a credible discrete presence, and whether NVIDIA chooses to defend its 94 percent share with more aggressive pricing or continues to rely on brand gravity. For now, Q3 2025 looks like a quiet inflection point: shipments are rising again, Intel is slowly bleeding share, NVIDIA keeps its gaming crown, and AMD is playing a longer game than meme culture likes to admit.

1 comment

still crazy to me that ppl are buying intel laptops in 2025 when there are ryzen options everywhere 😂