Pixel 10 rides a record month in the US as Apple’s iPhone 17 boom reshapes a mature market

The American smartphone market is not supposed to spring surprises this late in its life cycle, yet September 2025 delivered one. Counterpoint’s North America Handset Channel Share Tracker indicates that Google posted a 28 percent year over year jump in Pixel sales, achieving a single-month record for the brand. That milestone landed in the same window that Apple’s iPhone 17 family opened strong, underscoring an unusual moment when two very different playbooks both found traction in a market famous for slow churn.

What moved the needle for Google was not a single device but a stack working in concert. The value-minded Pixel 9a kept humming late into its run, but the new Pixel 10 line – and in particular the Pixel 10 Pro XL – became the horsepower behind the record. Google’s broad multimedia push hammered home deep Gemini integration across camera tricks, live transcription, translation, and on-device assistance. The message was simple: the phone is not just another slab, it is a daily AI companion.

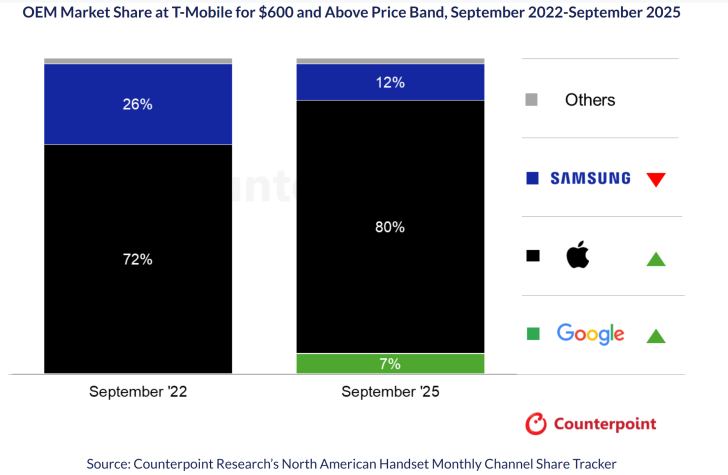

The numbers show genuine share capture where it matters. In the US 600-dollar-plus segment, Google’s presence climbed from a rounding-error 0.1 percent in September 2022 to 6.1 percent by September 2025. Inside carrier channels the gains are even more visible: approximately 6.5 percent at T-Mobile and 7.0 percent at Verizon, while AT&T remains a tougher nut at around 2.3 percent. That dispersion mirrors how promotions differ by operator and how shelf placement and store advocacy shape premium purchases.

Marketing alone did not do the work. US carriers have become co-authors of the Pixel story, pairing aggressive trade-ins and bill credits with the kind of instant-gratification financing that collapses premium price anxiety. For many buyers a smartphone now doubles as a fashion signal as much as a tool, and Google leaned into that cultural reality. One cheeky ad compared iPhone to vanilla ice cream, positioning Pixel as the flavor flight. Whether you buy the metaphor or not, the campaign did what advertising is supposed to do: it got undecided consumers to pick up the demo unit and ask questions.

Still, record months invite scrutiny. Enthusiast forums and comment sections have flagged complaints about heat under sustained load and battery life consistency on some Pixel 10 variants, alongside inevitable comparisons to Samsung’s S25 Ultra in endurance tests. Those data points are not universal – and software updates often smooth early quirks – but they matter to power users who push their phones hard. Others argue that previous-gen Pixels like the 7 and 8 remain sweet spots for privacy-tinkerers who value projects such as GrapheneOS, given their mature software support and price drops.

Competitive context is essential. The September spike is US-specific; it rides on carrier economics, Apple’s simultaneous iPhone 17 halo effect drawing foot traffic, and Google’s willingness to spend on awareness. It does not mean Samsung or Motorola are disappearing, though the latter’s persistent bloatware and preloads have clearly frustrated parts of the audience that might otherwise be open to a leaner Android experience.

Looking ahead, Google is preparing a Pixel 10a for early 2026 that appears deliberately conservative. Based on early CAD-based whispers, expect a familiar design with thicker bezels and a plastic back, a 6.2-inch display, dimensions around 153.9 x 72.9 x 9 mm, and a Tensor G4 tuned a bit higher than the 9a’s chip. Battery capacity is tipped at 5,100 mAh or more, and pricing is rumored to hover near 499 dollars. If that recipe holds, Google would be shoring up the lower end with durability and battery stamina rather than chasing headline design theatrics – a sensible counterweight to the premium Pixel 10 push.

The strategic takeaway is twofold. First, Google just proved that in a mature market you can still buy attention with the right mix of carrier leverage, playful advertising, and a clear AI story. Second, to convert a record month into durable share, the company must keep tightening thermal behavior and battery predictability on its flagship line while preserving the clean, timely software that built Pixel’s identity. If the forthcoming 10a lands with the rumored capacity and reliable performance, Google could build a one-two punch that funnels mainstream buyers into the Pixel world and keeps enthusiasts engaged until the next swing.

For now, the scoreboard reads simple: Pixel 10 is selling, iPhone 17 is selling, and US shoppers – helped by generous promos – are treating phones like both tools and style picks. In a landscape that often feels vanilla, September tasted like progress for Google.

1 comment

Motorola needs to chill with the preloads. Stop the spammy apps and maybe we talk. Also where’s ThinkPhone 2 already?