NVIDIA has once again taken the spotlight in the AI infrastructure race, but this time not just with raw performance numbers. The company is pushing a bold claim: its expensive Blackwell Ultra AI servers deliver a higher return on investment than even so-called ‘free’ GPUs.

At first glance, the idea sounds counterintuitive – how can paying millions yield more than zero-cost hardware? But according to NVIDIA, the difference comes down to scale, efficiency, and the ability to turn AI inference into real revenue.

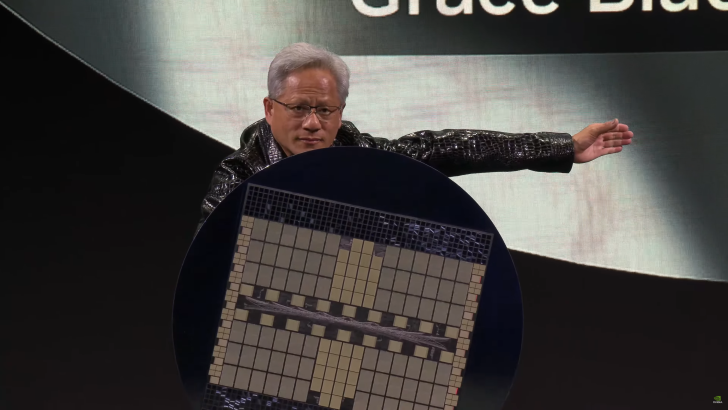

During a keynote presentation, Ian Buck, NVIDIA’s VP of Hyperscale and HPC Computing Business, highlighted the GB200 NVL72 rack as the centerpiece of this argument. The server, which carries a jaw-dropping price tag of around $3 million, was compared against a cluster of ‘free’ GPUs. Buck showcased a financial model where the NVL72 allegedly generates up to $30 million in revenue through AI token inference, representing a tenfold ROI. NVIDIA coined this effect ‘AI Factory ROI’ – positioning their servers not as mere hardware, but as industrial-scale profit machines for the age of generative AI.

The reasoning is tied to efficiency-per-dollar. Free GPUs, often older or less optimized, lack the power density and throughput needed to compete in hyperscale environments. They burn more electricity, deliver fewer inferences per second, and miss out on the advanced software ecosystem NVIDIA has built around its hardware. By contrast, NVIDIA’s systems aim to maximize revenue per watt and per rack space, making them appealing to cloud service providers (CSPs) who must squeeze profitability out of every data center square foot.

This strategy also explains Jensen Huang’s oft-repeated phrase: “the more you buy, the more you save.” In practice, it suggests that organizations deploying NVIDIA hardware at scale may offset their upfront costs with faster payback periods, higher throughput, and longer-term margins. Whether the numbers stand up to independent scrutiny remains an open question, but NVIDIA’s pitch is clear: don’t look at sticker price, look at profit yield.

Still, skepticism remains. Critics argue that ROI projections lack transparency, with no detailed methodology behind the $30 million revenue claim. Others point out that NVIDIA benefits by framing alternatives as outdated ‘free’ GPUs rather than modern competition. For many in the industry, it feels like another instance of NVIDIA mixing hard tech with marketing bravado. Yet even detractors admit one thing: in the current AI boom, no company has matched NVIDIA’s ability to sell the dream of profit as convincingly as they sell the silicon itself.

2 comments

true… jensen hype machine exploding rn xD

ngl PNY still cuts corners, saw their cards cheap but defo weaker materials