NVIDIA and Anthropic Bury the Hatchet With a $10 Billion AI Pact

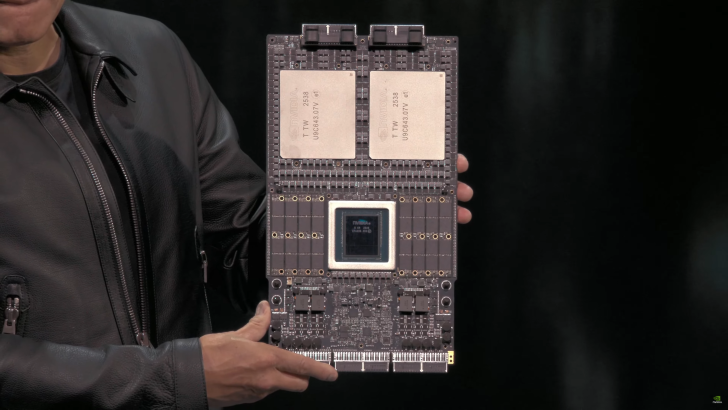

In the latest sign that artificial intelligence is reshaping not only technology but global finance, NVIDIA and Anthropic have quietly moved from uneasy rivals to high-stakes partners. The two companies have announced a sweeping deal that combines massive computing commitments with equally massive checks: Anthropic is locking in up to 1 gigawatt of compute based on NVIDIA’s Grace Blackwell and Vera Rubin systems, while NVIDIA is joining Microsoft in a funding round that could funnel up to $10 billion from Team Green and up to $5 billion from Redmond into Anthropic.

On paper, it is a straightforward trade. Anthropic, the company behind the Claude family of models, gets access to the most sought-after AI accelerators on the planet. NVIDIA, already the dominant arms dealer of the AI boom, secures yet another flagship customer in a market where demand for its chips still far outstrips supply. But look a little closer and this deal is about more than just hardware contracts and term sheets – it is a snapshot of an AI economy that looks increasingly dependent on a handful of players, and a market that many investors quietly fear could be a bubble waiting for a pin.

From Public Sniping to Strategic Alignment

The partnership is especially striking because Anthropic had recently been held up as a rare example of a top-tier AI lab that was not fully in NVIDIA’s orbit. The company made headlines when it became one of the first major adopters of Google’s seventh-generation Ironwood TPUs, a move widely interpreted as a challenge to NVIDIA’s grip on AI compute. At the same time, Anthropic’s leadership talked up its more cautious, safety-first philosophy and a relatively closed approach to model access, while NVIDIA’s Jensen Huang championed a more aggressive, scale-everything-up vision and pushed to keep shipping advanced GPUs even into politically sensitive markets.

Criticism flowed both ways. Huang did not hide his skepticism toward closed ecosystems that limited experimentation, and Anthropic’s camp raised eyebrows about the geopolitical implications of NVIDIA’s hardware strategy. For a while, it looked like the two companies were destined to sit on opposite sides of the AI divide: one built around Google and TPUs, the other around NVIDIA and its GPU empire.

Yet money, scale, and the sheer cost of frontier AI models have a way of smoothing rough edges. With Microsoft reportedly playing the role of power broker, Anthropic is now committing to an enormous NVIDIA-based footprint, in parallel with its existing agreements with Google. Rather than choosing a side, the company is hedging across all three of the main AI infrastructure blocs – Google, Microsoft, and NVIDIA – and sending a clear message that survival at the frontier layer requires every watt of compute it can secure.

The AI Bubble Question Hanging Over the Deal

Behind the triumphant press releases sits a more uncomfortable debate: is this a rational race to build the next foundational technology platform, or are we watching an AI bubble being inflated in real time? Many observers note that, so far, NVIDIA is one of the very few clear profit winners of the boom. Cloud providers and AI labs are spending tens of billions of dollars on hardware and data centers, but most of them have yet to prove that their models can consistently generate profits large enough to justify the investment.

That has led to a growing sense that money in this ecosystem is moving in circles. Big tech and investors pour capital into AI labs; those labs immediately spend it on NVIDIA hardware and cloud capacity; the resulting headlines about new partnerships and record orders push valuations even higher, enabling the next funding round. To critics, the NVIDIA–Anthropic pact looks like another turn of that flywheel, designed as much to reassure markets as to build long-term, sustainable businesses.

Supporters of the deal argue the opposite: that AI is not a speculative fad like trading cards or crypto tokens, but an infrastructure shift closer to the early internet or smartphones. From that perspective, enormous up-front investment is not a bug but a feature. Just as previous tech waves required years of loss-making build-out before profits arrived, today’s AI spending may look excessive until the productivity gains show up at scale.

What Happens If the Music Stops?

Still, even AI optimists admit there is real concentration risk. NVIDIA’s valuation and, increasingly, the broader stock market are tethered to expectations that AI spending will keep climbing. One disappointing earnings report or a pause in cloud capex could send shockwaves through Wall Street. The company has been here before: the sudden collapse of the cryptocurrency mining boom left NVIDIA with excess inventory and bruised investors, even if it ultimately recovered.

Critics warn that a similar scenario is possible in AI. If enterprises decide that today’s frontier models are too expensive to justify their returns, or if a cheaper hardware alternative takes off, AI labs could slam the brakes on GPU orders almost overnight. That would leave NVIDIA with tens of billions of dollars in long-term commitments for wafers, factories, and supply chains, and far less visibility into how quickly those chips can be sold at current margins.

There is also a subtler risk: NVIDIA sells shovels in the AI gold rush, but it does not control the gold. The real test for the Anthropic deal – and for the entire AI sector – is whether companies like Anthropic can turn Claude into something that delivers sustained economic value, automating tasks, cutting costs, and creating new revenue streams rather than just dazzling demos. If they cannot, the earnings estimates baked into today’s valuations will eventually collide with reality.

Why the Deal Still Matters

For now, though, the incentives are aligned. Anthropic gets guaranteed access to cutting-edge hardware in an era when capacity shortages can slow a model roadmap by months. NVIDIA strengthens its narrative as the indispensable supplier to every serious AI player, whether they also buy from Google or not. Microsoft deepens its influence over one of the most important independent labs, while simultaneously ensuring that those models are optimized for the Azure and NVIDIA stack.

End users may never see the fine print of this partnership, but they will feel its effects. More compute for Anthropic means faster training cycles, more capable Claude releases, and potentially more generous usage for paying customers frustrated by strict rate limits today. At a macro level, the deal underlines a simple truth: whatever you think about an AI bubble, the biggest names in tech are still willing to write enormous checks to keep the momentum going – and they are betting that by the time the hype cools, the infrastructure they are building will be too deeply woven into the economy to unwind.

1 comment

ai isnt pokemon cards tho, some crash will happen but the tech is def here to stay imo