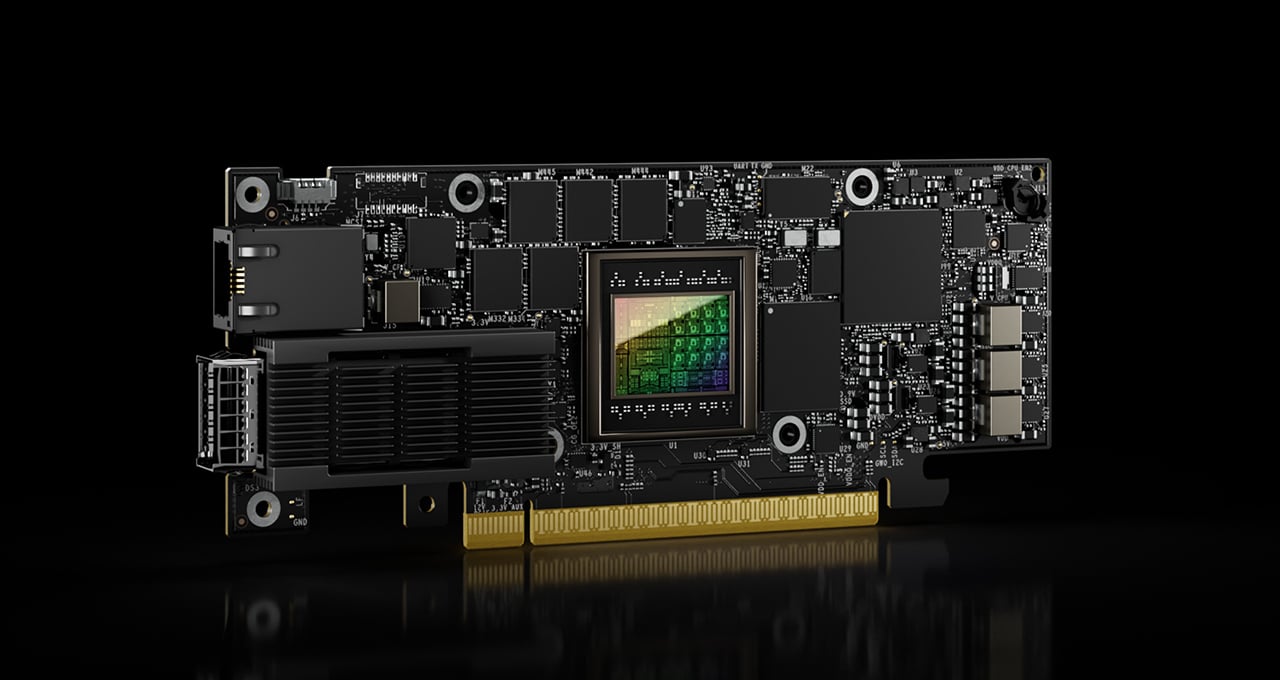

NVIDIA’s grip on the AI hardware market continues to strengthen, and fresh details emerging from JPMorgan’s latest investor briefing underscore just how pivotal the next generation of its chips will be. The spotlight this time falls on the highly anticipated Vera Rubin platform, a family of six GPUs that has now officially entered the final pre-production phase at TSMC.

For context, this stage confirms that all designs have been taped out, dismissing speculation of delays and keeping the roadmap aligned for a commercial launch in the second half of 2026.

According to JPMorgan analyst Harlan Sur, who attended the briefing with NVIDIA’s VP of IR and strategic finance, Toshiya Hari, demand for NVIDIA’s current-generation Blackwell Ultra GPUs remains extraordinary. Despite production ramping up sharply in fiscal Q2 – now making up half of the Blackwell lineup – lead times are still measured in quarters rather than months. This prolonged backlog more than two years into the AI investment cycle points to one clear reality: demand continues to far exceed supply.

The Vera Rubin platform has been engineered to extend NVIDIA’s dominance into the mid-2026 horizon, and the fact that all six chips are moving forward together highlights both TSMC’s commitment and NVIDIA’s confidence in its roadmap. The chips are expected to span multiple tiers, giving hyperscalers and enterprises a menu of options depending on whether they prioritize compute density, cluster scalability, or price-to-performance balance.

Meanwhile, international dynamics remain central to NVIDIA’s story. Reuters recently reported strong enthusiasm from Chinese tech giants including ByteDance and Alibaba for NVIDIA’s upcoming Blackwell-based B30A GPU, which is designed specifically for the restricted Chinese market. These companies are reportedly willing to pay up to twice the price of the older H20 to secure the B30A, attracted by claims of a sixfold performance leap. The hunger reflects both the growing urgency in China’s AI sector and NVIDIA’s unmatched ecosystem advantages, such as its CUDA software stack and NVLink interconnect that makes clustering more efficient than rival solutions.

It’s worth clarifying the distinctions in NVIDIA’s tailored portfolio. The B30 chip is a streamlined design compared with the more advanced B40, which itself powers the RTX Pro 6000D systems. While the B30 emphasizes scaling across multi-chip clusters with compression techniques to compensate for lower raw throughput, the B40 leans toward high-performance inference without relying on high-bandwidth memory, thus sidestepping export restrictions. This makes the RTX Pro 6000D especially appealing in China since it can be sold without additional licensing hurdles. Analysts expect these systems to enjoy rapid uptake once availability stabilizes.

The enduring question is how NVIDIA balances soaring demand with constrained supply, particularly as competitors like AMD and Intel push harder into AI accelerators. Still, NVIDIA’s software ecosystem, deep developer adoption, and unrivaled performance benchmarks continue to give it an edge. For investors, the confirmation that Vera Rubin remains on track is more than just a roadmap update – it signals continuity of leadership in a fiercely competitive landscape where AI compute has become the most sought-after resource of the decade.

Whether critics see media coverage as overly promotional or tied to stock market timing, the hard fact remains: NVIDIA is executing on its ambitious roadmap, its chips are in unprecedented demand worldwide, and the next phase of its GPU evolution is already on the horizon.

3 comments

idc about perf, just give me more vram, less power draw, and half the price

lol classic desperate nvidia hype piece right before market open 🤡

media quiet about jensen bribing politicians to sell gpus to china, wonder why 🤔