Apple’s iPhone 17 Pro Max may be the most technically advanced iPhone the company has ever shipped, but in the real world of wallets, discounts and tough economic choices, it is not the hero of the current sales charts. According to fresh shipment estimates for Q3 2025, it is the humbler iPhone 16e – the “entry ticket” to the iOS ecosystem – that has quietly sprinted ahead and even outsold Apple’s latest ultra-premium flagship.

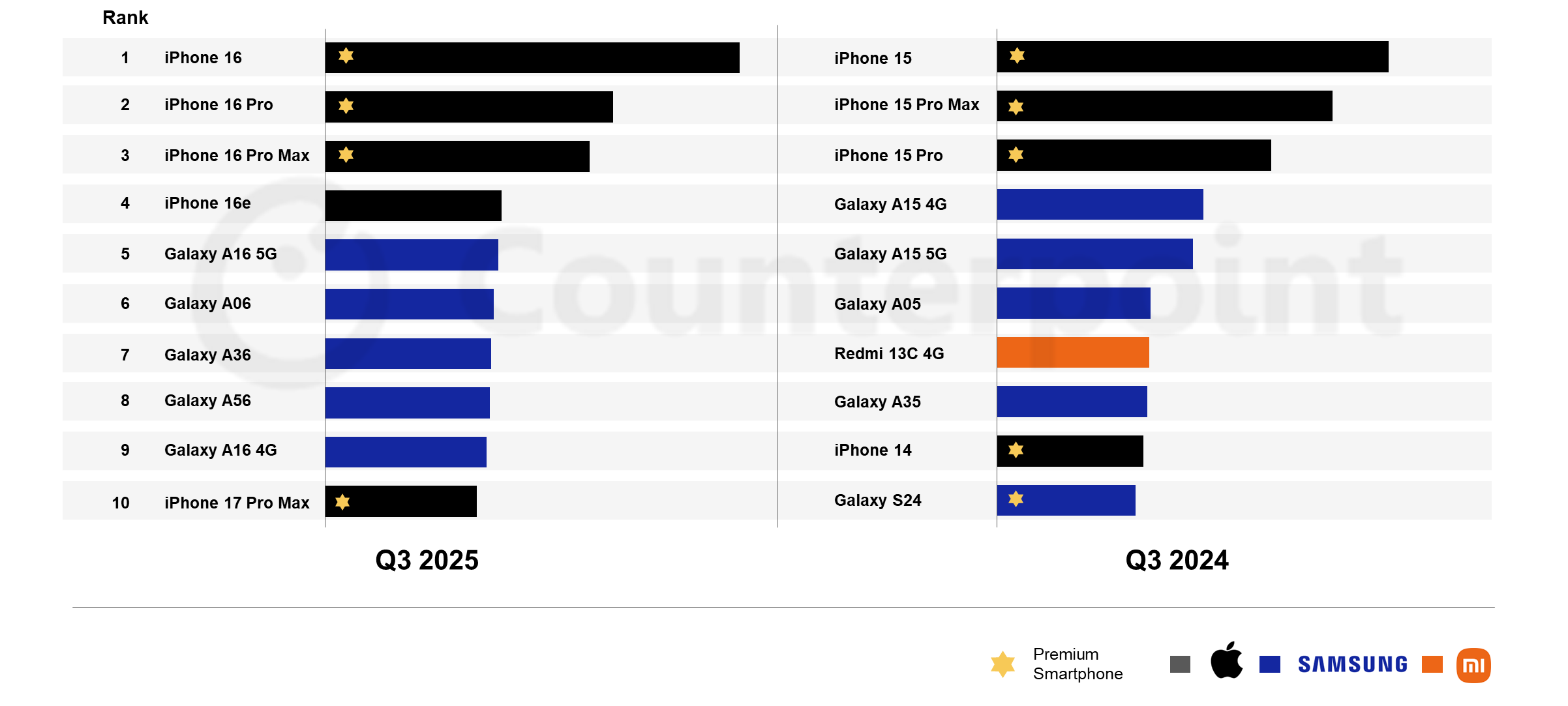

The ranking compiled by Counterpoint Research paints a picture that will make Apple’s finance team happy, even if it slightly bruises the 17 Pro Max’s ego. The overall top three spots are locked down by last year’s iPhone 16 trio: the standard iPhone 16 in first place, followed by the iPhone 16 Pro and iPhone 16 Pro Max.

Sitting just behind them in fourth place is the $599 iPhone 16e, a model built around cost-cutting compromises but carrying the one spec that matters most for many people – the Apple logo on the back.

Only then, all the way down in tenth place, do we meet the iPhone 17 Pro Max. No other iPhone 17 variant even breaks into the global top-10 list for the quarter. The rest of the chart is rounded out mostly by Samsung’s mass-market Android phones, with the Galaxy A16 5G standing out as the best-selling non-iPhone of the period. In other words, the smartphone market in Q3 2025 was dominated by last year’s Apple hardware and one aggressively priced Galaxy.

Counterpoint’s analysts note that the vanilla iPhone 16 alone captured about 4 percent of global smartphone volumes and has now managed to hold the number-one position for three quarters in a row. Strong festive-season promotions in India and an ongoing rebound in Japan helped keep shipments of the 16 series from collapsing when the shiny new iPhone 17 family hit the shelves. The story was different for the 16 Pro models, which saw steeper falls in key high-income markets such as the US, the UK and China as enthusiasts upgraded to the latest 17-series devices.

The iPhone 16e, however, appears to be playing a completely different game. Earlier this year there were reports that Apple’s cheapest 16-series phone was underperforming, but Q3 data tells the opposite story: in an environment of stubborn inflation and stretched household budgets, a “good enough” iPhone at several hundred dollars less than a 17 Pro Max suddenly looks like a smart buy. Many consumers can talk themselves into a $600–$700 purchase far more easily than a $1,300–$1,400 splurge, especially when day-to-day tasks like messaging, social media and streaming feel nearly identical across the range.

This is also a reminder that spec sheets do not always win against psychology and pricing. The 17 Pro Max brings Apple’s latest camera upgrades, a brighter display and the newest silicon, and it understandably performs well in affluent markets. But globally, the winning formula in 2025 is a mature design, stable software, long support windows and an installment plan that does not wreck the monthly budget.

For Apple, this isn’t a completely new pattern. A similar story played out with the iPhone 15 family in 2024, where the mainstream models quietly drove the bulk of volumes while the top-end variants grabbed the headlines. The Q3 2025 rankings simply reinforce the idea that “last year’s flagship” plus a price cut is often more attractive than the very latest gadget, especially outside the richest markets.

Looking ahead, analysts expect the pendulum to swing back toward Apple’s newest generation. If history repeats itself, the base iPhone 17 is well positioned to top the Q3 2026 bestseller list. It combines headline hardware – including a 3 nm A19 chip, 8 GB of RAM and, for the first time on a non-Pro model, an LTPO OLED display with ProMotion high refresh rate – with a price that undercuts the Pro and Pro Max while still feeling “next-gen” to upgraders coming from older devices.

A smooth 120 Hz-class ProMotion panel on the mainstream model could be especially important. Once users experience faster scrolling and more responsive animations, it becomes difficult to go back, and that alone may push a large slice of the iPhone 12–14 user base off the fence. Combined with Apple’s usual trade-in programs and carrier deals, the iPhone 17 might well become the default recommendation for most buyers next year, leaving the Pro and Pro Max as boutique options for camera nerds and spec hunters.

For now, though, Q3 2025 underlines a simple truth: in a shaky global economy, value-leaning “old” flagships can be more powerful than brand-new halo devices. Apple’s iPhone 16 lineup – and particularly the 16e – shows that the company does not need record-breaking price tags on every phone to dominate the charts. Sometimes the smartest play is to let last year’s champions keep quietly doing the heavy lifting.

2 comments

Tbh this is not shocking at all. In a recession ppl will pick a 600–700$ iPhone over a 1400$ flex brick every single time

Honestly the only reason I’d go 17 is that ProMotion screen, so if the regular 17 gets it next year, Pro Max can stay on the shelf for all I care