Apple’s iPhone 16 has cemented itself as the undisputed king of the smartphone world in 2025, proving once again that the so-called “vanilla” models often hold more power in the market than their pricier siblings.

What began as a slow burn following its fall 2024 release turned into a global surge: by Q1 2025, the 6.1-inch iPhone 16 had not only climbed to the number one spot but also expanded its lead throughout Q2, leaving Apple’s Pro models and competitors struggling to keep up.

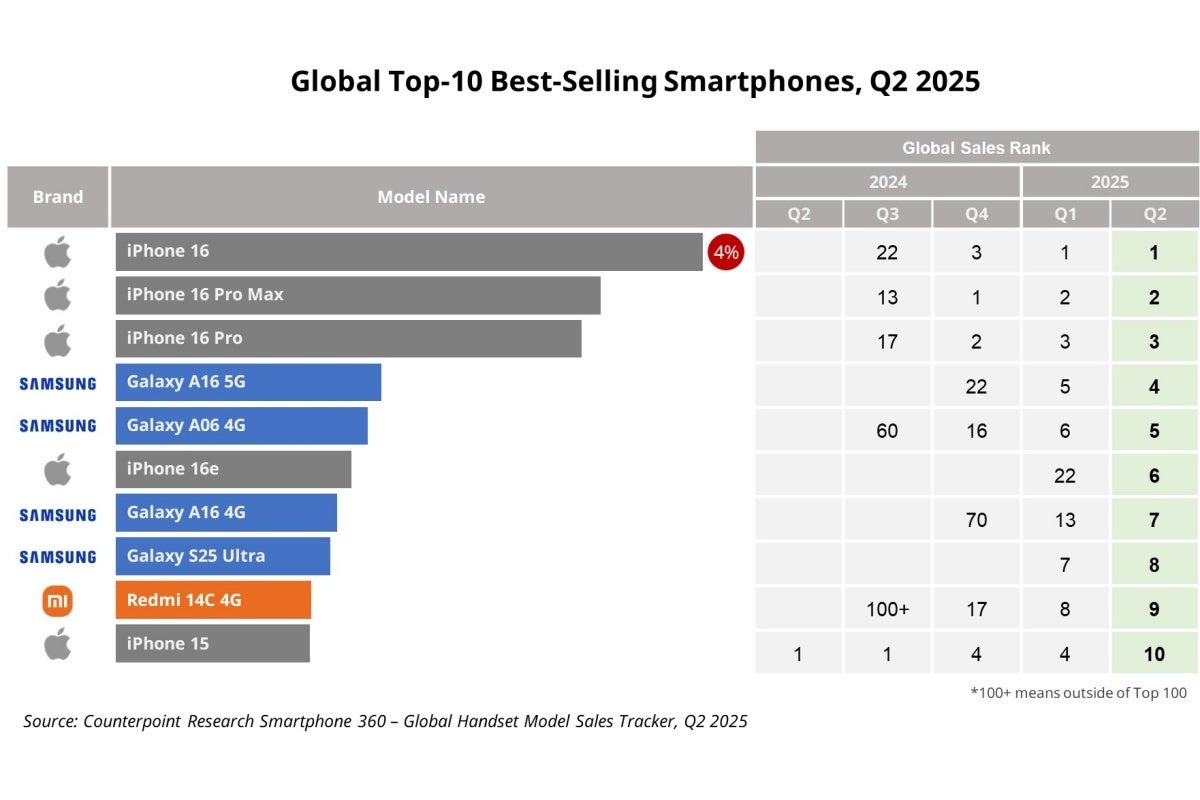

According to Counterpoint Research, Apple completely dominated the Q2 2025 sales chart, repeating the same lineup it held in Q1. The iPhone 16 sits at the top, followed closely by the iPhone 16 Pro Max in second place and the iPhone 16 Pro in third. This consistency shows how Apple’s tiered strategy continues to pay off: the mainstream iPhone appeals to a massive audience, while the Pro Max and Pro cater to enthusiasts craving larger screens or higher-end features.

The shake-up came in fourth place. In Q1, that spot was still held by the iPhone 15, a device that has now slipped down the ranking. Taking its place is Samsung’s budget-friendly Galaxy A16 5G, a reminder that Samsung’s bread and butter remains its affordable mid-range lineup rather than its ultra-premium flagships. Samsung also scored fifth with the Galaxy A06 4G, seventh with the Galaxy A16 4G, and eighth with its top-tier Galaxy S25 Ultra. The latter is still managing respectable sales despite its lofty price tag, which may have scared off some buyers after its early 2025 launch. Two consecutive top-ten finishes for such an expensive device, however, is no small feat.

Context matters here: while iPhones tend to enjoy steady momentum across months, Android flagships usually see an initial boom followed by a rapid tapering off. The fact that the Galaxy S25 Ultra still holds a place in the top ten even after the launch excitement has cooled suggests Samsung is keeping its premium appeal alive. Still, the quarter’s biggest winner remains the iPhone 16, which skyrocketed from a modest debut in Q3 2024 (where it ranked 22 due to limited availability) to third place in Q4, first place in Q1 2025, and an even firmer grip on the crown in Q2. The trajectory has been nothing short of meteoric.

Looking ahead, the real question is whether the iPhone 16 can score a third consecutive quarterly win. If history is any indication, the odds are high. The iPhone 15 held onto the global crown in Q2 and Q3 2024, and the iPhone 16 appears to be an even bigger commercial success. However, the competition is about to heat up with the fresh arrival of the iPhone 17 lineup: the iPhone 17, 17 Pro, 17 Pro Max, and the brand-new iPhone Air.

Apple enthusiasts and analysts alike are watching closely to see how the iPhone 17 series will reshape the chart. With less than two weeks of availability in Q3, these new models might not crack the global top five immediately, but early indicators are strong. Last year, the iPhone 16 Pro Max came very close to breaking into the top five in its first partial quarter. Reports suggest that the iPhone 17 Pro Max has already surpassed its predecessor in terms of pre-orders, suggesting it may hold the crown temporarily. Still, history shows that once the dust settles, the “standard” version usually rises above the rest. For that reason, many believe the iPhone 17 will eventually dethrone the 17 Pro Max and dominate sales for several consecutive quarters.

Meanwhile, the iPhone 16e deserves a nod of recognition. Positioned as a more affordable option, it managed to outsell not only the previous-generation iPhone 15 but also Samsung’s Galaxy A16 4G and even the Galaxy S25 Ultra in Q2. This reinforces the idea that Apple’s lower-cost models can siphon off sales from both the budget and premium categories, putting extra pressure on Samsung’s mid-range dominance.

But Samsung isn’t Apple’s only rival. Xiaomi has once again broken into the top ten with a single low-cost model, the Redmi 14C 4G, which grabbed ninth place. The Redmi’s performance highlights how Xiaomi continues to disrupt the Apple-Samsung duopoly by appealing to price-sensitive markets across Asia and beyond. Even though the Redmi 14C is slipping down the rankings and may not remain in the top ten by Q3, its presence demonstrates the enduring appeal of ultra-affordable smartphones.

The broader takeaway from Q2 2025 is clear: Apple maintains its iron grip on the top three global positions, Samsung continues to find strength in numbers through its Galaxy A lineup, and challengers like Xiaomi remain the wild card in the mix. The iPhone 16’s triumph also reinforces a fascinating pattern – despite Apple’s heavy marketing of Pro features like advanced cameras and titanium builds, the mainstream model consistently captures the hearts and wallets of most buyers. It’s the balance of price, performance, and brand power that makes the “vanilla” iPhone so hard to beat.

As Q3 unfolds, all eyes will turn to the iPhone 17 family. Will the Pro Max or the new iPhone Air disrupt the pecking order, or will the formula repeat itself with the standard model rising to the top once again? If the past year is any indication, the next Counterpoint chart will bring more evidence of Apple’s dominance, punctuated by Samsung’s budget resilience and Xiaomi’s guerrilla strikes in the low-cost sector. One thing is certain: the battle for global smartphone supremacy has never been more predictable at the top, yet still unpredictable at the edges.