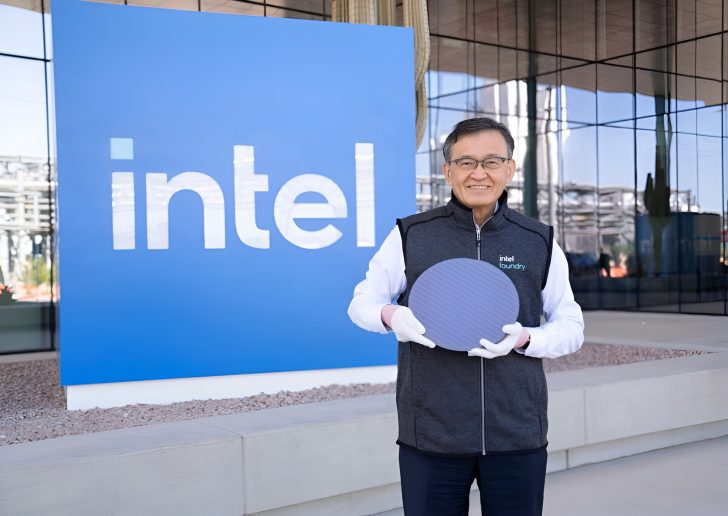

Intel’s CEO Lip-Bu Tan is taking bold steps into the Middle East, seeking fresh capital and strategic partnerships that could redefine the company’s future. The veteran executive recently met with Saudi Arabia’s Minister of Communications and Information Technology, Abdullah Al-Swaha, to discuss potential collaborations in the fields of semiconductors, advanced computing, and artificial intelligence infrastructure.

The meeting signals a clear ambition: to secure a foothold for Intel in one of the world’s fastest-growing regions for tech investment.

For Intel, which has struggled to maintain its dominance amid fierce competition from AMD, TSMC, and NVIDIA, this move could represent a pivotal shift. Under Lip-Bu Tan’s leadership, the company has already been exploring alliances with heavyweights like SoftBank and even engaging in cooperative talks with the U.S. government to secure semiconductor resilience. Now, with Saudi Arabia in the picture, Intel appears to be targeting the heart of the Gulf’s trillion-dollar diversification effort – where oil money is being rapidly redirected toward tech innovation, renewable energy, and digital infrastructure.

The Arab News report detailing Tan’s meeting did not disclose specific project details, but industry insiders suspect Intel could be eyeing large-scale chip fabrication initiatives or AI research hubs in the region. Saudi Arabia, through its Vision 2030 agenda, has been accelerating investments in technology to transform its economy beyond oil dependence. The nation’s Public Investment Fund (PIF) already holds stakes in multiple global tech ventures, including those connected to SoftBank’s Vision Fund, giving it direct exposure to Silicon Valley and beyond. With this kind of financial firepower, a partnership with Intel could provide the company with the capital infusion and political support needed to expand production capacity and regain technological momentum.

However, skepticism remains. The Middle East lacks a strong manufacturing ecosystem for high-end chips, and countries like Qatar and the UAE have previously tried – and failed – to attract chipmakers such as TSMC due to logistical and supply chain challenges. Yet, Intel’s position is different: it is not only seeking to build but to survive. With global chip demand fluctuating and U.S. government subsidies still slow to materialize, the idea of leveraging Gulf wealth to sustain long-term R&D and infrastructure expansion is becoming increasingly attractive.

Intel’s latest discussions with Saudi officials also reflect a broader geopolitical pattern: Western tech giants are seeking to align with Gulf nations not just for funding but for strategic influence. For Saudi Arabia, this could mean a faster climb toward becoming a legitimate player in AI and semiconductor technology. For Intel, it could mean access to untapped markets, sovereign wealth funding, and the opportunity to diversify production away from traditional hubs in Asia. If successful, the collaboration might mark a new chapter in the global chip race – one where capital and innovation find common ground in the desert.

While it’s too early to know the exact outcome, one thing is certain: Intel’s leadership under Lip-Bu Tan is aggressively pursuing every possible avenue to reinvent Team Blue’s future. Whether this alliance with Saudi Arabia becomes a genuine manufacturing leap or just another round of diplomatic posturing remains to be seen – but for now, the Middle East seems ready to bankroll the next big semiconductor gamble.