With NVIDIA set to announce its fiscal Q2 earnings tomorrow, Wall Street is split on the outlook.

Goldman Sachs has issued a cautious note, while Morgan Stanley maintains optimism, particularly around the ongoing uncertainty in China.

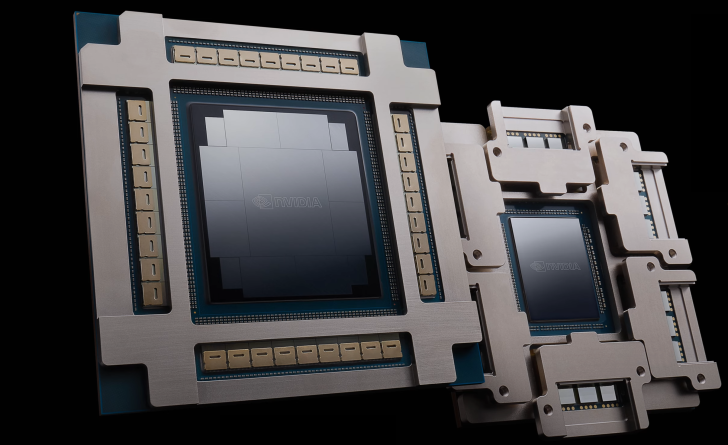

Goldman Sachs warns that despite NVIDIA’s strong first-half performance in 2024, history suggests the stock often struggles in the latter half of the year. The firm highlights the absence of fresh catalysts, pointing to muted capital expenditure guidance from mega-cap tech players. Without significant spending updates, Goldman believes NVIDIA’s momentum could fade until the next investment cycle begins early next year. The bank maintains a Buy rating with a $200 target price, but stresses that clarity on capex, details on the upcoming Rubin AI GPUs, and NVIDIA’s standing in China will be decisive for H2 2025 performance.

Morgan Stanley, however, takes a more positive stance. It notes that the turbulence of the first half – ranging from the DeepSeek selloff to concerns over Blackwell delays – has largely passed. The firm forecasts $52.5 billion in revenue for NVIDIA’s October quarter, while some investors expect as high as $55 billion. According to its analysts, NVIDIA’s cautious tone on China could actually help reset investor expectations, creating more transparency around future performance. Despite ongoing restrictions on H20 GPUs in China, Morgan Stanley believes the conservatism will ultimately be constructive for the stock’s outlook.

As the two Wall Street giants diverge in tone, investors are left balancing Goldman’s warnings of a cooling second half with Morgan Stanley’s belief in a stronger, more certain ramp over the next 12 months. All eyes now turn to NVIDIA’s earnings call to see which vision of the future holds true.

1 comment

idk man, nvidia too expensive rn… feels risky 🤷♂️