China’s ambitions in the global semiconductor race are shifting into a higher gear as two of its most important memory manufacturers, YMTC and CXMT, prepare to join forces. The partnership is aimed at developing advanced high-bandwidth memory (HBM) solutions, a critical technology for artificial intelligence, data centers, and supercomputing.

If successful, this collaboration could reshape the balance of power in the memory industry and chip supply chains.

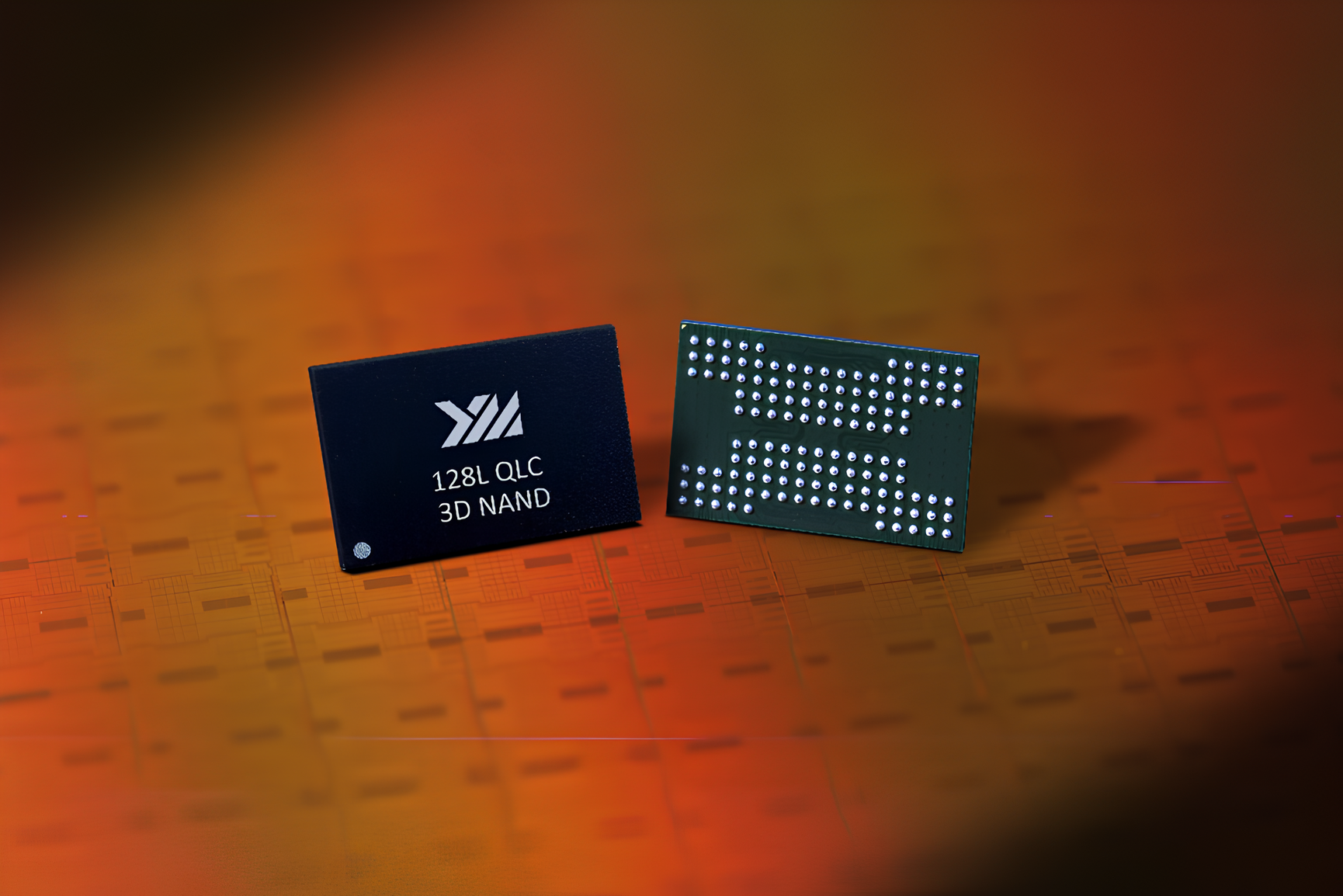

YMTC, previously known for its NAND expertise, is now making a bold move into the DRAM sector. Reports suggest that the company has already begun ordering specialized equipment for DRAM R&D, a clear sign that it wants to secure a foothold in the next generation of HBM. For YMTC, teaming up with CXMT provides a fast track into the world of high-performance memory, where the learning curve is steep and costly.

On the other side of the alliance, CXMT has emerged as China’s largest DRAM producer and is already manufacturing HBM2 at scale. According to industry insiders, CXMT is not stopping there – it has moved into producing HBM3 engineering samples, which are now being tested by potential customers. By contributing hybrid bonding and other critical technologies, CXMT could enable YMTC to leapfrog early hurdles and jointly scale up China’s domestic HBM production capacity.

At the heart of this push is China’s drive for self-reliance. Following years of heavy restrictions and U.S. export controls targeting its semiconductor sector, the country has doubled down on developing homegrown solutions. YMTC, once a partner of Samsung and a significant NAND supplier, saw its global prospects shrink under sanctions. Now, by investing heavily in DRAM and HBM, the company is signaling that it intends not just to survive but to compete head-to-head with established giants.

The implications extend far beyond China. South Korean firms like Samsung and SK hynix dominate the global HBM market, but this emerging partnership could disrupt that lead. While Korean companies still hold technological advantages and deeper patent portfolios, the speed at which Chinese firms are catching up is raising eyebrows across the industry. If YMTC and CXMT can establish reliable production lines and scale them quickly, they could significantly reduce China’s dependence on foreign suppliers and offer competitive alternatives in global markets.

For now, the key question is execution. Developing cutting-edge DRAM and HBM requires not just funding but years of accumulated know-how. Skeptics point out that Chinese firms have made similar promises in the past without achieving breakthroughs. However, the fact that HBM3 samples are already circulating for testing adds credibility to the claim that progress is real this time. Whether this leads to mass production at competitive yields will determine if YMTC and CXMT can truly shift the memory landscape.

What is clear is that the semiconductor battle has entered a new phase. With AI adoption exploding worldwide, demand for HBM is skyrocketing. China’s determination to secure a share of this market through partnerships like YMTC and CXMT could accelerate its technological independence and potentially reshape how and where the world’s most advanced chips are made.

1 comment

cxmt got hbm3 samples already, ppl testing them rn 🔥