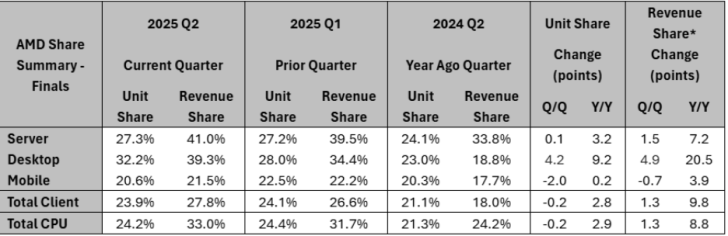

AMD has delivered an exceptional Q2 2025 performance, with its desktop Ryzen CPUs seeing the largest market share surge in years, nearly matching the revenue dominance of its EPYC server lineup. According to Mercury Research, AMD’s desktop unit share jumped to 32.2%, up from 28% last quarter and just 23% a year ago, marking almost a 10% year-over-year increase.

Desktop revenue share soared to 39.3%, only slightly behind the server segment’s record 41%.

On the server front, EPYC CPUs maintained strong momentum, hitting 27.3% unit share and an all-time-high 41% revenue share – the best since EPYC’s debut

. Growth was fueled by robust cloud and enterprise demand, with AMD’s roadmap pointing toward future gains through the upcoming Turin, Venice, and Verano architectures.

Client revenue share rose to 27.8%, while mobile revenue share reached 21.5%, despite a slight quarter-over-quarter dip. Mobile shipments, at 20.6% unit share, are still up compared to last year, with Ryzen AI 300 and Ryzen AI MAX chips driving demand but facing limited availability.

AMD’s latest Zen 5-based Ryzen 9000 and 9000X3D processors, particularly the X3D models, have been outperforming Intel’s offerings in retail charts. Rumors suggest AMD will expand the X3D lineup to target both mainstream and enthusiast users, potentially extending its winning streak. With both Ryzen and EPYC firing on all cylinders, AMD’s x86 CPU momentum shows no sign of slowing down in the near future.

3 comments

EPYC name still makes me chuckle

rip intel, its over guys

guess my next build gonna be am5 for sure