Samsung spent the last few years watching rivals SK hynix and Micron dominate the high bandwidth memory race, but that storyline is finally starting to flip. After painful delays and failed qualifications, the Korean giant is on the verge of turning its HBM division from an embarrassment into a growth engine. Industry chatter now points to NVIDIA preparing to sign off on Samsung HBM4 stacks, potentially as early as this month, putting Samsung back into the most profitable corner of the AI hardware supply chain.

To understand why this matters, you have to rewind a bit.

While demand for HBM3 and HBM3E exploded with the AI boom, Samsung repeatedly stumbled. Early HBM modules struggled with both DRAM reliability and brutal thermal challenges that come with stacking many layers of memory and driving them at very high speeds. NVIDIA and other hyperscalers were ruthless in qualification, and Samsung kept losing designs to SK hynix in particular, which became the default supplier for the hottest AI accelerators on the market.

Internally, Samsung went back to the drawing board. Instead of trying to patch old designs, the company reworked its 1c DRAM technology from the ground up for HBM4, pairing it with a modern 4 nm base die. The goal was simple but unforgiving: deliver the bandwidth NVIDIA wants, hit power and thermal targets, and do it with yields good enough to support mass deployment, not just pretty lab demos. According to Korean media reports, Samsung has now cleared its internal production readiness approval for HBM4 chips and is shipping samples to major customers for final quality and reliability testing.

Those samples are already in the hands of players like NVIDIA, and analysts say the last external verifications could be completed as soon as this month. Samsung has hinted publicly that its relationship with NVIDIA has been repaired around HBM4, but the real test will be how the chips behave once volume ramps. Yield will be the key metric: HBM stacks are expensive to build, and one weak layer can kill an entire stack. If Samsung really can keep yields in line with expectations using its 1c DRAM plus 4 nm base die combo, it will finally stand shoulder to shoulder with SK hynix and Micron in AI memory.

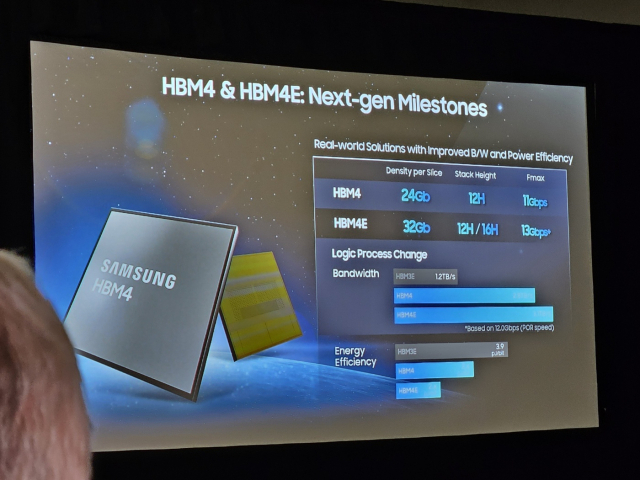

On paper, HBM4 looks exactly like the kind of product that could change that balance. Samsung is targeting pin speeds of around 11 Gbps, which translates to roughly 2.8 TB per second of memory bandwidth per stack, depending on configuration. The roadmap does not stop there: HBM4E is already being discussed with speeds above 13 Gbps per pin, pushing aggregate bandwidth into the 3.2 TB per second range and beyond. To make its offering irresistible, Samsung is said to be pairing those speeds with aggressive pricing, fully aware that hyperscalers will split orders to any vendor that can deliver performance at scale.

Behind the scenes, capacity is quietly being reshuffled to feed this HBM hunger. A noticeable slice of fabs that had been expanded for DDR5 and GDDR6 now appears to be sliding over toward HBM4 production, reflecting where the real margins are. In a world where every major cloud provider is racing to train larger models, practically anyone who can build high bandwidth memory can sell everything they can produce. For Samsung, which has endured a rough stretch of weak DRAM prices and disappointing yields, HBM4 is not just a prestige project, it is a financial lifeline.

NVIDIA, meanwhile, has strong incentives to bring Samsung back into the fold. Relying too heavily on a single HBM vendor is a strategic risk when entire AI roadmaps, including upcoming architectures such as Vera Rubin class accelerators, depend on secure memory supply. Jensen Huang and his team need more than one partner capable of feeding their insatiable GPU lineup, and Samsung gaining full HBM4 qualification effectively turns the duopoly into a three way fight again. More suppliers mean more negotiating power for NVIDIA, better redundancy for the ecosystem, and potentially more predictable lead times for customers that are currently queueing for hardware months in advance.

Samsung is also not building HBM4 just for NVIDIA. Interest is coming from AMD, who wants competitive memory options for its own AI accelerators, and from hyperscalers such as Google, Meta, and Amazon that are designing custom AI ASICs and need enormous bandwidth budgets. For those chips, HBM is no longer a luxury add on; it is a prerequisite for staying competitive. If Samsung can hit volume with solid yields, its HBM4 stacks will quickly find homes far beyond a single GPU vendor.

All of this, however, leaves PC gamers watching from the sidelines. Many consumer enthusiasts have already resigned themselves to the idea that HBM4 will live almost exclusively in data centers, while gaming graphics cards continue to rely on GDDR memory. GDDR7 is the next big step on that side, and Samsung once talked up eye catching 48 Gbps speeds as early as late 2024. Reality has been slower and more complicated, and now SK hynix is preparing to showcase 48 Gbps capable GDDR7 at events like ISSCC 2026, with mass production likely drifting toward the middle of the decade. By the time that level of GDDR7 shows up in real gaming GPUs, we could easily be talking about 2027.

Even then, raw bandwidth numbers show why HBM is being reserved for premium AI silicon. Run GDDR7 at 36 Gbps on a 256 bit bus and you are looking at roughly 1.1 TB per second. A 384 bit bus pushes that toward 1.7 TB per second, and a monster 512 bit design would hit around 2.3 TB per second. Those are huge numbers by gaming standards, but they still look modest next to a single HBM4 stack at 2.8 TB per second or future HBM4E stacks that break 3 TB per second on their own. The kind of 512 bit GDDR7 board that would really challenge HBM4 will likely be reserved for ultra flagship GPUs with ultra flagship prices.

That is why Samsung getting HBM4 right matters far beyond its own balance sheet. A stronger third player keeps SK hynix and Micron on their toes, gives NVIDIA and other chipmakers more flexibility when planning multi year roadmaps, and reduces the risk of the entire AI boom being throttled by a single supplier bottleneck. For the broader market, more competition at the top often filters down in the form of faster innovation, better energy efficiency, and at least some pressure on prices, even if mainstream gaming hardware does not get shiny new HBM stacks any time soon.

For now, one thing seems certain: the era when Samsung was an also ran in high bandwidth memory is ending. If NVIDIA signs off on HBM4 as expected and yields hold up in mass production, the Korean giant will have clawed its way back into the center of the AI revolution. After being left behind in the early waves of the HBM gold rush, Samsung finally looks ready to surf the next one.

3 comments

And watch, even with all this HBM4 hype we still wont see it on normal gaming gpus, only on datacenter bricks ofc 🤦♂️

Anyone building memory right now is basically printing money, they can sell everything they make before it even leaves the fab

Did yall notice like 40% of those fabs that were supposed to spit out DDR5 and GDDR6 are now being pointed straight at HBM4? consumer stuff gonna stay expensive lol