When Apple unveiled the iPhone Air, the story was supposed to be all about engineering bravado. A 5.6 mm thin chassis, premium materials, and the aura of being the sleekest iPhone in the lineup made it look like a future classic.

Instead, just a few weeks after launch, the iPhone Air has become the most rapidly depreciating iPhone released since 2022, and the resale data is brutal, especially for buyers who stretched their budgets for the 1 TB model.

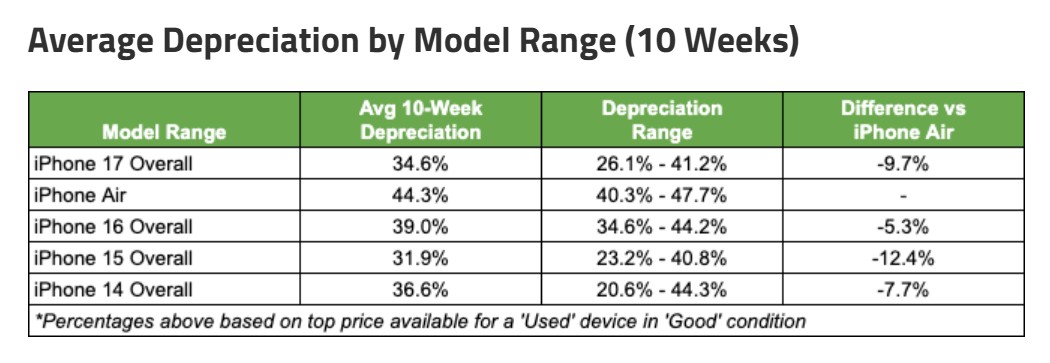

Market trackers report that the iPhone Air has surrendered 47.7 percent of its value within the first ten weeks on sale. That is not a gentle slide; it is a cliff. On average, across its different storage options, the Air is down around 44.3 percent in less than three months, with the 1 TB configuration suffering the most painful drop. For a device that was marketed as a halo product for the iPhone 17 generation, the mismatch between hype and demand could not be more obvious.

Meanwhile, the rest of the iPhone 17 lineup is quietly doing what Apple flagships usually do best: holding value better than most of the Android world. Taken as a whole, the iPhone 17 family shows an average depreciation of 34.6 percent after ten weeks. That is still a hit, but it is an improvement over the iPhone 16 series, which slid by about 39.0 percent in the same time window, and the iPhone 14 family, which dropped around 36.6 percent. The real benchmark, however, is the iPhone 15 series, which still reigns as Apple’s resale champion with only 31.9 percent depreciation over ten weeks.

Within the current generation, the gap between the iPhone Air and its siblings is stark. Other iPhone 17 models are retaining roughly 9.7 percent more value than the Air. The iPhone 17 Pro and iPhone 17 Pro Max, the true workhorses of the lineup, are at the top of the resale charts. The iPhone 17 Pro Max with 256 GB storage has seen a relatively modest 26.1 percent decline, while the 512 GB version is down about 30.3 percent

. These are still expensive phones to flip quickly, but they behave like typical premium iPhones rather than risky experiments.

Things get more interesting at the very top end of the storage ladder. You might assume that spec monsters with 2 TB of storage would be rare, desirable and therefore more resilient on the secondhand market. The numbers tell a different story. The 2 TB iPhone 17 Pro Max has already lost about 41.2 percent of its value, which suggests that ultra high storage tiers are appealing to only a tiny niche of buyers. Once that initial wave of enthusiasts has purchased, there are not enough people willing to pay close to launch prices on the used market.

Even that looks tame compared to what is happening to the iPhone Air. Its 512 GB and 1 TB variants are shedding value even faster than the 2 TB 17 Pro Max. For many buyers, the premium for extra storage simply does not translate into real world resale power. In other words, you may be paying top dollar now for capacity that the next owner does not really care about, especially when the device itself is a niche model whose production is rumored to have been scaled back due to weak demand.

Part of the problem is positioning. The iPhone Air sits in a strange place in Apple’s lineup. It is thinner and more design driven than the regular iPhone 17, yet does not quite replace the rugged versatility and camera flexibility of the Pro and Pro Max models. Enthusiasts love the engineering story, but mainstream buyers prefer proven all rounders. The result is a phone that costs like a flagship but behaves like a limited edition experiment when it comes to resale value.

Online, reactions mirror this disconnect. Some users jokingly ask who trades in a phone after six months, calling early sellers suckers for taking such a rapid hit on value. Others simply shrug and say that anyone buying the Air at full price knew what they were getting into. At the same time, there is a smaller group of bargain hunters openly hoping to scoop up lightly used iPhone Air units for a fraction of their original price, throwing out offers in the 200 dollar range with a mix of irony and genuine interest.

Yet there is a practical angle here that goes beyond memes. Many buyers do cycle through phones quickly, either because they are enthusiasts who always want the latest model, or because their carrier upgrade plans make frequent swaps easy. For that crowd, depreciation is not an abstract number; it directly affects how much they effectively pay each year to stay current. In that context, a near 50 percent loss in ten weeks transforms the iPhone Air from a stylish toy into a financial red flag.

Looking ahead, the situation could become even more uncomfortable for iPhone Air owners. Apple is expected to roll out the iPhone 18 line in 2026, alongside the long rumored iPhone Fold. As usual, there will be an official trade in program and a bustling used market surrounding the launch. If the current trend continues, owners walking into that cycle with an iPhone Air, especially the 1 TB version, may find the trade in offers disappointingly low compared to what owners of other iPhone 17 models receive.

So what should you do if you are already holding an iPhone Air? There are essentially three strategies. You can keep it long term and ride out the depreciation curve, treating it as a daily driver you are genuinely happy with rather than a short term investment. You can offload it sooner rather than later, before the next wave of price cuts and trade in quotes drags values down further. Or you can try to pivot into a different iPhone 17 model this year, ideally a Pro or Pro Max with lower storage, if you know that you will want to move to the iPhone 18 generation in 2026.

For shoppers who are still deciding which iPhone 17 to buy, the lesson is simple. If resale value matters to you, the data strongly favors the mainstream flagships over the ultra thin, ultra niche Air. Choose a configuration that matches how you actually use your phone, rather than maxing out storage for the sake of spec sheet bragging rights. The market has shown that high capacity tiers do not automatically translate into higher resale returns.

In the end, the iPhone Air is a fascinating case study in how design ambition, pricing and buyer psychology collide. As a piece of hardware, it is one of the most striking iPhones Apple has built. As an asset, it is one of the fastest shrinking. Unless Apple dramatically changes how it positions devices like the Air, the safest financial play will remain the same as it has been for years: buy the popular model, keep storage reasonable, and let the hype phones depreciate in someone else’s pocket.