In a year dominated by aggressive Chinese brands and looming global economic worries, few expected Apple’s iPhone 17 to stage its biggest comeback in China.

Yet that is exactly what happened in October, when the iPhone 17 series quietly turned into the country’s unexpected sales champion in the premium segment, reshaping the narrative around Apple’s position in the world’s most competitive smartphone market.

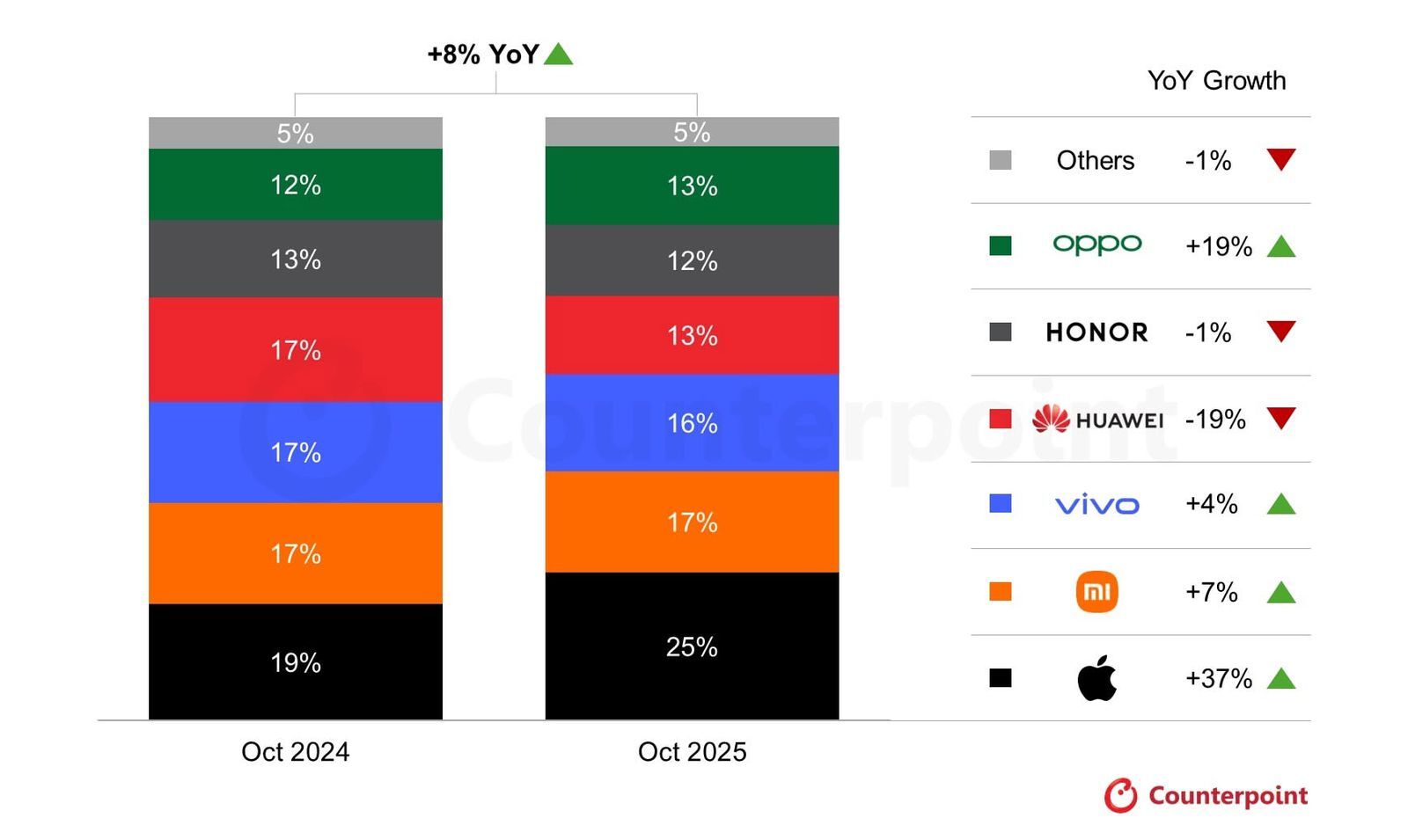

Fresh data from Counterpoint Research shows that roughly one in every four smartphones sold in China in October was an iPhone. That translates into about 25% market share for the month and a remarkable 37% year-on-year jump in iPhone sales. For Apple, which had been under pressure from local brands and geopolitical noise, this marks its strongest start to the December quarter ever, even surpassing the record set back in October 2021.

The iPhone 17 finds its moment in China

Apple has not enjoyed this level of sustained momentum in China since 2022. The difference now is that the competitive landscape has changed dramatically. Where Apple once faced only a few high-end rivals, the premium tier is now crowded with aggressively priced flagships from Xiaomi, OnePlus, and – of course – Huawei, which continues to sell strongly at home despite the lack of Google services on its devices. In that context, seeing iPhone 17 sales surge is more than a simple upgrade cycle; it signals that Apple’s brand, ecosystem, and feature set still resonate with Chinese buyers.

According to Counterpoint senior analyst Ivan Lam, the new iPhone 17 family accounts for more than 80% of all Apple smartphones sold in China during the period. The base iPhone 17, alongside the two Pro-branded models, posted double-digit percentage growth, with the standard iPhone 17 leading the pack. In other words, Chinese consumers are not just buying older discounted models; they are gravitating toward the newest and most expensive devices in Apple’s lineup.

What the numbers really show

The raw figures behind this surge reveal how important the iPhone 17 has been for the entire Chinese smartphone market:

- iPhone devices captured around a quarter of all smartphone sales in China in October.

- Overall iPhone sales climbed roughly 37% compared to the same month a year earlier.

- The broader Chinese smartphone market grew about 8% year-on-year, meaning Apple grew far faster than the market.

- Chinese giant Xiaomi climbed into the number two position for the first time in more than a decade, underscoring just how intense the competition at the top has become.

In this environment, Apple’s growth is not happening in a vacuum. Chinese brands are also rising, but the iPhone 17 is clearly driving a disproportionate share of the overall recovery in smartphone demand.

Specs vs. status: why buyers still choose iPhone 17

From a pure hardware perspective, many Chinese flagships arguably look more impressive on a spec sheet than the iPhone 17. Higher megapixel counts, faster wired charging, larger batteries and aggressive pricing are the norm among local brands. As some observers have noted, it would be fascinating to sit down with Chinese iPhone buyers and ask why they still pick Apple when local phones seem to offer “more phone for less money.”

The answer is rarely just about specs. For many users, the iPhone is still a status symbol, a safe choice and, importantly, an entry ticket into Apple’s tightly integrated ecosystem of services, accessories and software. Services such as iCloud, iMessage, FaceTime, AirPods integration and the long-term promise of software updates create a sticky environment that spec-focused rivals struggle to replicate. Even users who openly admit that some Chinese models look stronger on paper often describe the iPhone as the device they trust not to slow down, break, or lose value too quickly.

That makes the 37% jump in iPhone 17 sales feel less like a fluke and more like a renewed vote of confidence. One industry watcher summed up the sentiment bluntly: the growth is huge, but when it is Apple, you almost expect the brand to pull off numbers other companies can only dream of.

What makes the iPhone 17 different

Part of this success is simply the product itself. The iPhone 17 base model finally fixes one of the biggest complaints around Apple’s non-Pro phones: the lack of a high-refresh-rate screen. With a 120 Hz display, smoother animations and a more fluid interface, the iPhone 17 feels more in line with what Android users in China have been getting in mid-range and flagship phones for years. For many long-time iPhone fans, this was the missing piece that kept them from upgrading.

On top of the screen, Apple kept pricing essentially flat while quietly improving value. Storage tiers are more generous than before, cameras and processing have been tuned for better low-light performance and video, and battery life is competitive. While the iPhone Air variant has reportedly received a much cooler reception, the main trio of iPhone 17 models – the standard, Pro and Pro Max – feels like the most balanced lineup Apple has offered in years.

For regular users who just want a reliable phone that takes good photos, runs popular apps smoothly and feels premium in hand, the base iPhone 17 now covers almost everything they need. The Pro models are still there for heavy users and enthusiasts, but for the average buyer, spending more is no longer mandatory just to get a modern display and solid battery life.

Huawei, Xiaomi and the looming Mate 80 challenge

Apple’s momentum in China does not mean it can relax. Ivan Lam warns that sustaining this surge will be difficult once Huawei’s Mate 80 series arrives, with its launch set for November 25. Huawei’s return to high-end chipsets and its strong patriotic appeal at home make the Mate 80 lineup a serious threat, especially among buyers who want to support a domestic brand.

Meanwhile, Xiaomi’s rise back to the number two spot for the first time in over ten years shows that Chinese brands are not standing still. Xiaomi’s flagships and upper mid-range phones offer exceptional value and aggressive promotions, often with charging speeds and camera hardware that outgun Apple on paper. OnePlus and other players continue to push boundaries too, ensuring the premium Android landscape remains vibrant and relentlessly competitive.

Galaxy S26 and the next round of the flagship war

Outside China, Apple’s main global rival remains Samsung. The Korean company is preparing its Galaxy S26 series, widely expected to debut in February. Early reports suggest that the Galaxy S26 Ultra could bring a redesigned camera bump, significantly faster charging and more polished Qi2 wireless charging support. All of these are features that will put pressure on Apple in global markets, and they will matter in China as well, where Samsung has been trying to claw back relevance.

If Samsung delivers a genuinely transformed S26 Ultra, and Huawei’s Mate 80 series lands as strongly as expected, Apple’s iPhone 17 will suddenly find itself flanked by two formidable Android flagships on either side. That is when we will see whether the current iPhone surge is a short-lived spike or the beginning of a longer cycle of renewed strength in China.

Should you upgrade to the iPhone 17?

For many people still holding onto older base iPhones, the iPhone 17 feels like the first truly compelling upgrade in years. The 120 Hz display, improved cameras, better battery optimization and extra storage at the same price point address most of the traditional complaints about Apple’s entry model. Unless you absolutely need the additional camera hardware, higher-end display brightness or specific professional features of the Pro models, the standard iPhone 17 finally offers the complete package.

Some tech enthusiasts are still hesitating, but for a different reason: rumors of Apple’s first foldable iPhone, expected to surface sometime next year. For those users, the iPhone 17 is the device that tempts them to upgrade now, while the idea of a foldable keeps them waiting just a little longer. Either way, Apple wins: the company has a mainstream hit today with the iPhone 17 series, and a potentially disruptive new form factor on the horizon.

What October’s numbers make clear is that, in the world’s most fiercely contested smartphone market, the iPhone 17 has managed not only to survive but to dominate. Spec sheets may point to Chinese rivals as the better deal, yet millions of buyers in China are voting with their wallets and choosing Apple again. In a market where loyalty is hard-won and easily lost, that 37% surge is more than a statistic; it is a reminder that the iPhone still sets the tone for the entire industry.

3 comments

I’ve been skipping the base iPhones for years because of that slow 60 Hz screen. Now that the 17 finally has 120 Hz, this is the first time the non-Pro looks worth my money

Waiting to see what Huawei does with Mate 80 before I decide. iPhone 17 looks good, but I kinda want to support a local brand if the experience is close enough

Galaxy S26 vs iPhone 17 vs Mate 80 is gonna be a fun fight. I’m just here for the memes when charging speeds are compared again