Samsung’s next battle with Apple may not unfold on a spec sheet but at the checkout terminal. Instead of teasing another Galaxy flagship, the company is reportedly preparing a Samsung-branded credit card for the United States – built on Visa’s global network and issued in partnership with Barclays.

If true, this would mark a strategic shift from pure hardware competition to a deeper, stickier rivalry around everyday spending, loyalty, and the digital wallet you use to pay.

From phones to finance: why Samsung wants a card

Hardware is cyclical. Financial services are continuous. A co-branded card gives Samsung recurring visibility every time a user taps, swipes, or autofills online. It’s a way to strengthen the Samsung Wallet experience, reward loyal buyers, and funnel incentives back into the ecosystem – whether that’s a new Galaxy, a QLED TV, or a smart fridge. In short, a card turns occasional product purchases into a long-term relationship rooted in payments, rewards, and financing.

The rumored partners – and how the plumbing fits

Each participant brings something vital. Visa provides wide merchant acceptance and mature risk, tokenization, and dispute tools. Barclays contributes underwriting, issuing expertise, and credit operations in the US. Samsung supplies brand, distribution, and a wallet where incentives can live and be spent. That trio creates a path to launch at scale without Samsung building a bank from scratch.

What the day-one product could look like

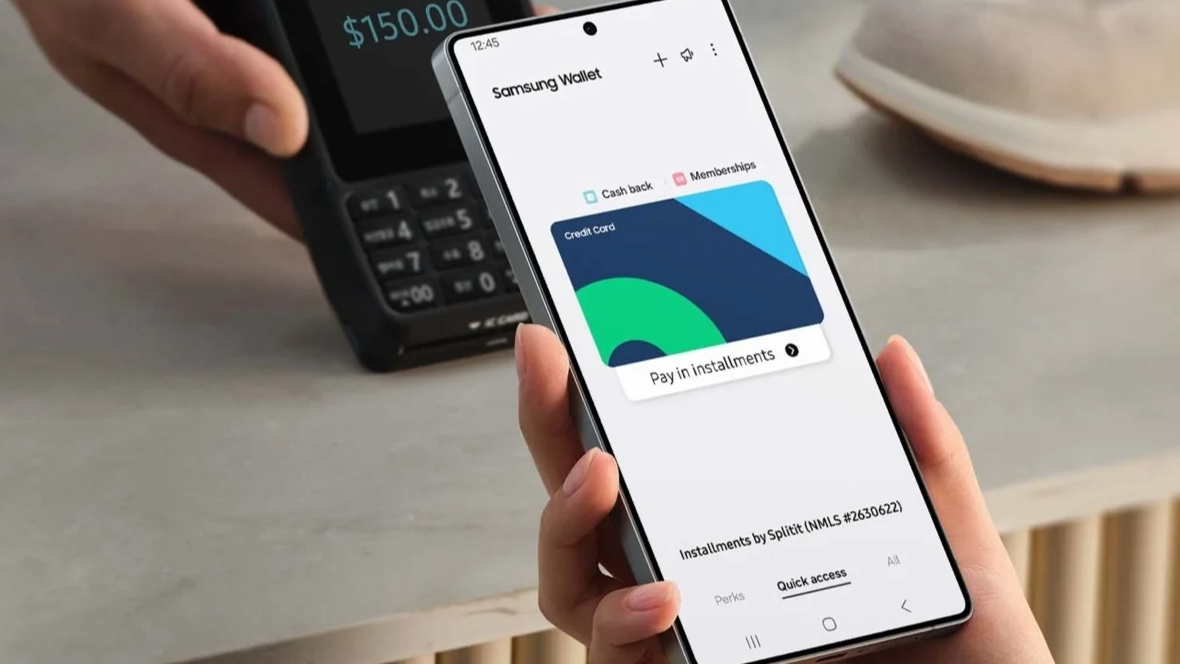

Expect a straightforward consumer credit card with rewards tuned to the Samsung universe. Cashback or points credited directly to Samsung Wallet is the obvious move: earn on groceries or fuel, then redeem seamlessly on Galaxy accessories, subscriptions, or checkout discounts during the next device upgrade. The card could also offer promotional financing on Samsung hardware – another proven lever to keep buyers cycling through the brand’s catalog.

A broader money toolkit, not a one-off

Signals suggest the card would anchor a small suite of personal finance features. A high-yield savings account would let users park rewards and cash in one place; a digital prepaid account could appeal to younger users or those wary of credit; and a buy-now-pay-later (BNPL) option would address big-ticket purchases with predictable installments. Together, these tools extend Samsung Wallet from a storage app into a true financial hub.

Following Apple’s 2019 template – and trying to outdo it

Apple’s playbook is clear: the Apple Card, launched with Goldman Sachs on Mastercard, coupled daily cash rewards with tight integration across Apple Pay and interest-free financing on Apple hardware. The result was stronger ecosystem gravity. Samsung’s rumored approach mirrors that logic while swapping partners: Barclays for issuing and Visa for rails. The opportunity to differentiate lies in category bonuses, richer device-upgrade deals, and Wallet-first redemption that feels instantaneous at Samsung checkout.

Why this matters in the US market

The US is competitive for cards but uniquely receptive to co-brands that deliver tangible perks. For Samsung, a card creates more reasons to keep Galaxy owners from drifting to other wallets or marketplaces. For consumers, it could consolidate everyday spend, device financing, and rewards into a single experience that speaks the same design language as their phone, watch, and TV.

What Barclays gains

Co-branded issuing is about distribution and loyalty at scale. Samsung’s US footprint offers Barclays a pipeline of creditworthy applicants, recurring interchange revenue, and cross-sell potential. In return, Samsung gets credit expertise, compliance infrastructure, and a mature servicing model – capabilities that would take years to build independently.

Risks and frictions to watch

- Underwriting & compliance: Balancing growth with responsible lending in a shifting regulatory environment.

- Rewards sustainability: Splashy launch bonuses must give way to long-term economics that still feel generous.

- Customer support: A seamless hardware brand must match that standard when disputes or fraud occur.

- Wallet adoption: Perks must be strong enough to change behavior – taps instead of plastic, Wallet redemptions instead of generic statement credits.

Timing and telltales

Reports point to a formal announcement targeted before year-end, with Visa handling the network role. The clearest signs to watch: Samsung Wallet updates that emphasize rewards management, references to Barclays in marketing materials, and device-purchase flows that surface special financing tied to the card.

The bigger picture: from your pocket to your wallet

Samsung and Apple have long fought over screen size, cameras, and chipsets. Now the rivalry extends to statements, APRs, and reward ledgers. If Samsung executes, the credit card won’t just subsidize your next Galaxy – it will reframe the company as a daily financial companion. The contest is no longer only about the phone you buy every few years, but the card you use every day.