DDR5 Prices Just Doubled: What’s Really Driving the Spike – and How Builders Can Adapt

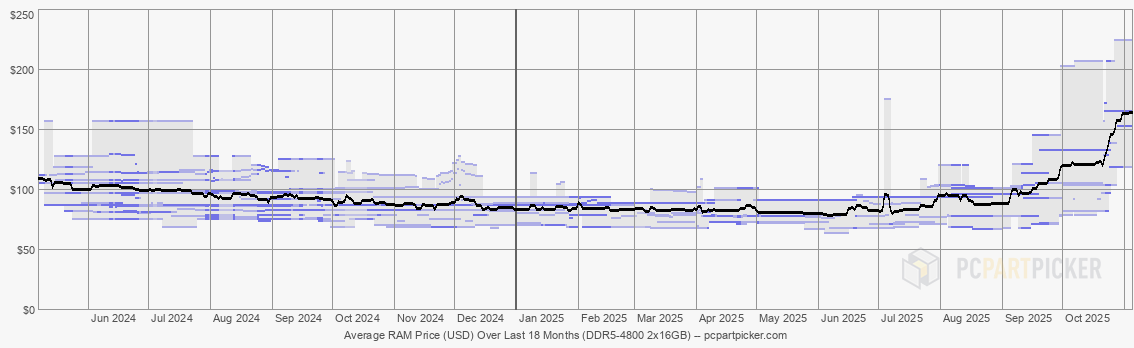

DDR5 memory has raced to an all-time high across major retailers, with many 16 GB and 32 GB kits now costing roughly twice what they did only a few months ago. What started as a steady climb between late summer and early fall has become a full-blown surge as demand for DRAM spilled over from the AI server world into the consumer channel. Back in August and September, the industry braced for 20–30% increases. Then came 60–80%. Now we’re seeing effective 2× pricing on popular capacities and speed bins, and some SKUs have soared by more than 170% versus their spring lows. If you’ve put off a RAM upgrade, you’ve probably just met the worst timing of the year.

How AI Pulled the DRAM Rug From Under PC Builders

The core of the shock is simple: the biggest buyers of memory right now are building AI infrastructure, and hyperscale data centers will pay top dollar to secure supply. DRAM makers have redirected wafer starts toward high-bandwidth memory (HBM) and other premium lines feeding GPUs and accelerators, while also keeping a tight rein on overall output. That choice makes business sense – enterprise buyers are price-insensitive when a single rack’s productivity depends on having the right memory in place – but it leaves consumer DDR5 and even DDR4 short. When supply tightens, the channel moves in lockstep: distributors and retailers stretch lead times, initial batches vanish, and the price ladder resets at a higher rung.

Receipts From the Front Lines: Sticker Shock in 16 GB and 32 GB Land

Real-world baskets tell the story. Anecdotally, a 64 GB kit that cleared for around £255 in mid-2023 now lists near £495. A few months back, extreme-speed 32 GB DDR5-7600 kits flirted with fire-sale tags under $100; today, buyers are staring at $400-plus for mainstream DDR5-6000 in two-DIMM kits. Entry 32 GB (16×2) kits at 4800 MT/s that lived comfortably under $100 have drifted into the $160–$170 band, while 5200 MT/s is circling $200. The sweet-spot 5600–6000 bins – once the value favorites for Ryzen 7000 and 12th–14th-gen Intel builders – are regularly posted around $230–$300 for two sticks, with faster 6400–7200 kits commanding far more. Single 32 GB modules have crested $150 in some listings, and dual-stick 32 GB kits marketed as “budget” have quietly crossed the $400 mark at certain storefronts.

DDR4 and SSDs Aren’t Immune

While DDR5 is the headline, DDR4 has also firmed up. DRAM is a shared manufacturing base; when producers pivot to higher-margin products, older standards get fewer fresh lots and ride the same rising tide. The ripple effect is also showing up in NAND flash. If you’ve noticed fewer aggressive SSD deals, you’re not imagining it – channel inventories are tightening, and price floors for consumer and enterprise drives are edging up in step with memory markets.

The Cyclical Truth (and Why This Cycle Hurts More)

Veteran builders know memory moves in cycles: periods of oversupply bring bargains, then a shock – natural disaster, fab retooling, or a demand spike – snaps prices back. What makes this cycle unusual is its catalyst. AI isn’t a short-lived fad on the supply side; it reshapes where DRAM capacity is pointed and for how long. As long as accelerator shipments rise quarter over quarter, HBM and server-bound DRAM remain the priority. That doesn’t mean consumer prices can’t ease, but it does mean the path back down is likely measured in months, not weeks.

What It Means for Gamers, Creators, and Small Shops

For a lot of rigs, RAM was supposed to be the “cheap, easy win” upgrade, especially alongside a mid-cycle GPU or CPU refresh. The new math complicates those plans. Builders speccing 32 GB for gaming and light creation may reconsider 16 GB temporarily, but remember that modern titles and background apps are far more memory-hungry than they were even two years ago. Creators working in 4K timelines, simulation hobbyists, and local-AI tinkerers feel the pinch most: 32 GB is the new baseline, and 64 GB often isn’t luxury – it’s headroom that keeps systems from thrashing. Some power users report projects that casually chew through 20 GB on their own; once you add a browser, editor, and cache, your “budget build” can become I/O-bound fast.

Smart Buying Playbook (For an Expensive Moment)

- Target stable sweet spots: 5600–6000 MT/s remains the pragmatic blend of speed, compatibility, and price (such as it is) for most mainstream platforms. Chasing binned 6400–7600 kits adds cost with limited real-world payoff for most users.

- Two sticks beat one: If you must compromise, avoid single-DIMM “temporary” buys that lock you into single-channel performance. A 2×16 GB kit runs better today and scales later with a matched 2×16 set if your board and IMC are happy with four sticks.

- Don’t over-DIMM without a reason: Four-DIMM configs can stress memory controllers and limit clocks. If you truly need 64 GB, favor 2×32 over 4×16 on platforms that support it well.

- Mind XMP/EXPO sanity: With stressed supply, variance creeps in. Favor vendors with solid QVL support for your motherboard, and be prepared to tune voltages or settle one speed bin lower for rock-solid stability.

- Watch restocks and bundles: Some retailers will refresh at the new baseline but still run motherboard-plus-memory or CPU-plus-memory bundles that undercut standalone kit pricing.

- Consider interim DDR4 builds only if it truly fits: On older platforms, topping off DDR4 may be cheaper than jumping to a new board/CPU/DDR5 all at once. But don’t strand yourself if a full platform swap is on your near-term roadmap.

When Do Prices Cool Off?

Forecasts are murky. The broad expectation inside the channel is that pricing requires a few months to normalize after wafer allocations stabilize and seasonal demand clears. If enterprise AI orders keep gobbling capacity, relief may be gradual. Historically, memory makers avoid flipping from shortage to glut overnight; they steer a tighter course to protect margins. The practical translation for consumers: plan as if elevated prices will linger through the near term and treat any sudden promo as opportunistic rather than a new normal.

The Bottom Line

We’re living through a rare moment when consumer DDR5 swims against a powerful current. AI build-outs are soaking up DRAM, vendors are channeling capacity to higher-margin parts, and the remainder is priced accordingly. For builders, that means discipline: buy once, buy right, and avoid false economies that sabotage performance. If your workload genuinely needs 32 GB or 64 GB, under-buying will cost you more in time and frustration than the sticker price you’re trying to dodge. If you can wait, watch the charts and set alerts; if you can’t, pick a proven 5600–6000 MT/s kit from a vendor with strong QVLs and keep the rest of your build balanced. The cycle will turn – eventually. Until then, treat memory like a premium component again, because for now, that’s exactly what it is.