The DRAM Supercycle: How AI is Driving Unprecedented Demand for Memory

Artificial intelligence (AI) has made a significant impact on industries across the board, disrupting traditional systems and supply chains. One area where AI has begun to show its power is in the demand for DRAM (Dynamic Random-Access Memory). According to multiple reports, the demand for DRAM is poised to skyrocket in the coming years, largely due to the massive adoption of High-Bandwidth Memory (HBM) and the development of custom Application-Specific Integrated Circuits (ASICs) by major tech companies.

AI’s push for DRAM is not just about new chip development; it’s about scaling up production to meet the needs of high-performance computing clusters. Every AI cluster requires substantial HBM capacity per chip, which, in turn, drives a huge increase in DRAM demand. The need for DRAM has escalated to the point where it’s now viewed as a critical component, just as essential as the chips themselves. Big Tech, especially AI giants, is now rushing to build custom ASICs to enhance internal systems and services, which further fuels the DRAM demand.

UBS analysts have recently projected that the demand for DRAM will rise exponentially over the next few years. According to their report, OpenAI is planning to launch a new ASIC that will incorporate 12-Hi HBM3E technology, which alone could require an additional 500,000 to 600,000 DRAM WPM (Work Processing Memory) between 2026 and 2029. This estimated demand is coming from a single player in the industry, OpenAI, highlighting just how significant the potential for DRAM suppliers is. If this demand materializes as expected, DRAM companies will face immense pressure to scale production to meet it.

The DRAM industry is forecasted to hit 1.955 million WPM by 2026, but even that figure may not be enough to keep up with the accelerating demand. The global DRAM inventory is currently at an alarmingly low level of just 3.3 weeks, the shortest it has been in the last seven years. Historically, inventory levels hover around 10 weeks, signaling a significant imbalance in the supply-demand dynamic.

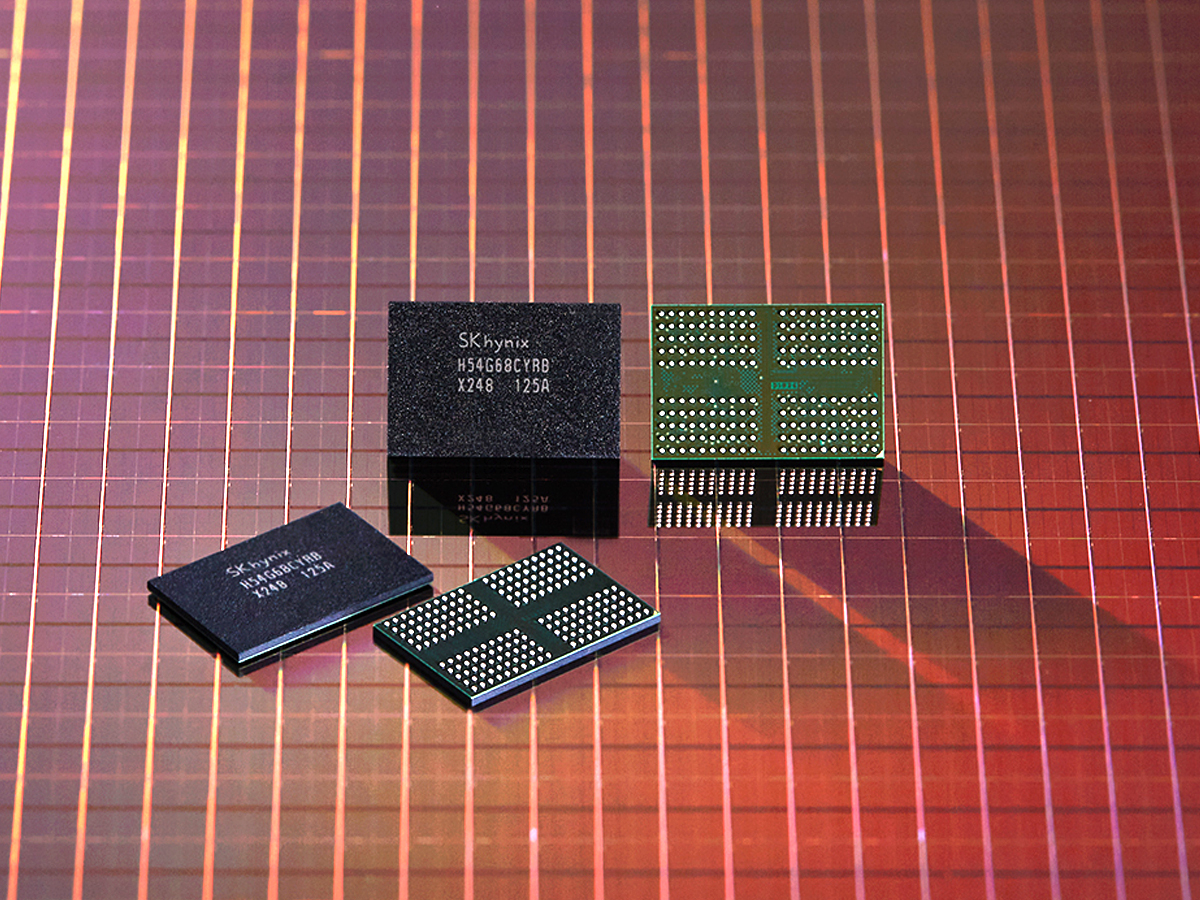

Major DRAM suppliers, including Samsung, SK hynix, and Micron, are already redirecting resources to produce more HBM by repurposing existing production lines and advancing process technologies. Currently, the process node for DRAM is at 1c, but to meet the demand, these companies may need to adopt more advanced technologies to keep up.

Beyond custom AI chips, DRAM is also integral to the operations of data centers, where demand continues to grow. For instance, OpenAI’s Stargate project is expected to consume a massive 900,000 DRAM WPM. That’s nearly 40% of the global DRAM supply at current levels, further highlighting the strain on available resources. With such an unprecedented surge in demand, all eyes are on manufacturers, especially those based in South Korea, to see how they will adapt to this new reality.

Micron and SK hynix are taking steps to diversify their production by building new facilities in the United States. However, questions remain about whether these new plants will be able to come online in time to meet the looming demand. The DRAM industry, traditionally concentrated in Korea, is about to undergo a significant transformation as tech giants and semiconductor manufacturers scramble to stay ahead of AI’s rapid growth.

Looking ahead, technologies like HBM4 will only further amplify the demand for DRAM. Big Tech companies, led by AI advancements, are currently at the forefront of driving HBM demand, and the only way to sustain this growth is by dramatically increasing DRAM supply. If manufacturers can’t ramp up quickly enough, the industry may face significant supply shortages, which could delay AI advancements and innovation across various sectors.

As we watch this space, it will be crucial to track the progress of DRAM production, the development of HBM technologies, and how major players like NVIDIA and OpenAI continue to shape the landscape. The coming years will undoubtedly be critical for the DRAM industry, as demand skyrockets and the race to build the next-generation chips accelerates.

1 comment

I guess we’ll see who comes out on top in the DRAM game. Micron and SK hynix have some serious competition now