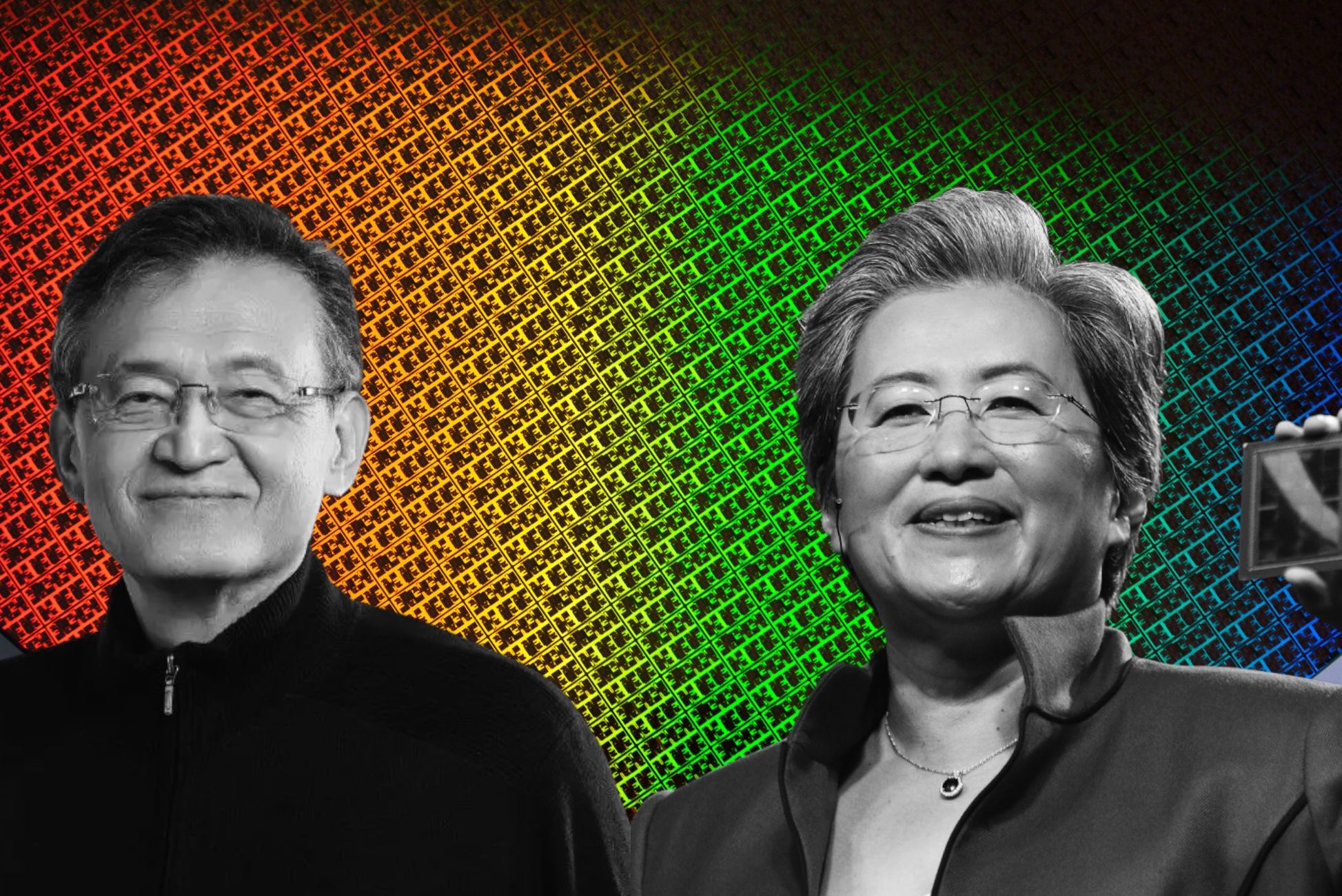

Intel is reportedly making a bold and somewhat surprising move: attempting to secure AMD, its long-time competitor, as a foundry customer. According to fresh reports, Team Blue has entered early discussions with AMD about potential collaborations on its forthcoming 18A and 14A process nodes.

If this materializes, it could represent one of the most unusual yet impactful shifts in the semiconductor landscape.

Over the past few months, Intel has been repositioning itself as not just a designer of CPUs but as a global foundry player, eager to attract external clients. This push is backed not only by business ambition but also by significant political weight. Following investment interest from entities such as SoftBank and visible encouragement from the Trump administration, Intel has been under close watch and guidance to strengthen its domestic manufacturing role. The company’s foundry division, Intel Foundry Services (IFS), has been marketed as a strategic alternative to Asia-dominated players like TSMC and Samsung, especially given the geopolitical uncertainties around Taiwan.

On the surface, the idea of AMD turning to Intel for chip production might sound strange. Historically, the two have been fierce rivals in the CPU market. Yet, history also shows precedent: in 2018, the Kaby Lake-G project saw Intel CPUs paired with AMD Radeon Vega GPUs, a deal that stunned many at the time but proved that business pragmatism can outweigh rivalry. In today’s context, such a partnership could allow AMD to diversify its supply chain while maintaining leverage over TSMC.

The timing is crucial. AMD has been relying heavily on TSMC’s advanced nodes, including N2, for products like its EPYC CPUs. But with TSMC under pressure from rising costs and political scrutiny, Intel may sense a rare opportunity to offer an alternative. If Intel’s 18A node delivers on promises of improved performance-per-watt, density, and yield, it could tempt companies like AMD to allocate at least part of their production to Intel’s fabs. Analysts speculate that even shifting non-core components, such as I/O dies (IODs), could be a strategic first step.

Still, skepticism remains high. Intel’s track record with advanced nodes is marred by delays and failed transitions, notably the much-publicized struggles with 10nm and the drawn-out ramp of 7nm. Critics argue that Intel’s reassurances about 18A and 14A are steeped in overconfidence – or, more cynically, desperation. Many believe that courting AMD is as much about proving the viability of Intel’s new foundry business model as it is about technical confidence.

From a political angle, AMD’s potential participation could play well with Washington, aligning with U.S. interests in strengthening domestic semiconductor manufacturing. But from a business perspective, AMD would need to tread carefully: aligning too closely with Intel could create supply-chain risk and might complicate its long-standing reliance on TSMC, a partner that has delivered consistent results.

In the end, this story highlights Intel’s dual strategy: fighting to regain its technical edge while simultaneously reinventing itself as a foundry powerhouse. Whether AMD bites or not remains uncertain, but the fact that discussions are even on the table shows just how dramatically the industry dynamics are shifting. If Intel can truly deliver with 18A, the balance of power in global chipmaking could tilt in unexpected ways.

1 comment

Bro this feels like hopium straight from wccftech, don’t fall for it