NVIDIA is once again at the center of the AI hardware conversation, with new estimates suggesting that shipments of its cutting-edge Blackwell GB300 enterprise AI systems could surge by 300% in the third quarter.

If these projections hold true, it would mark one of the most aggressive scaling phases in NVIDIA’s history, underscoring the insatiable demand for high-performance computing in artificial intelligence workloads.

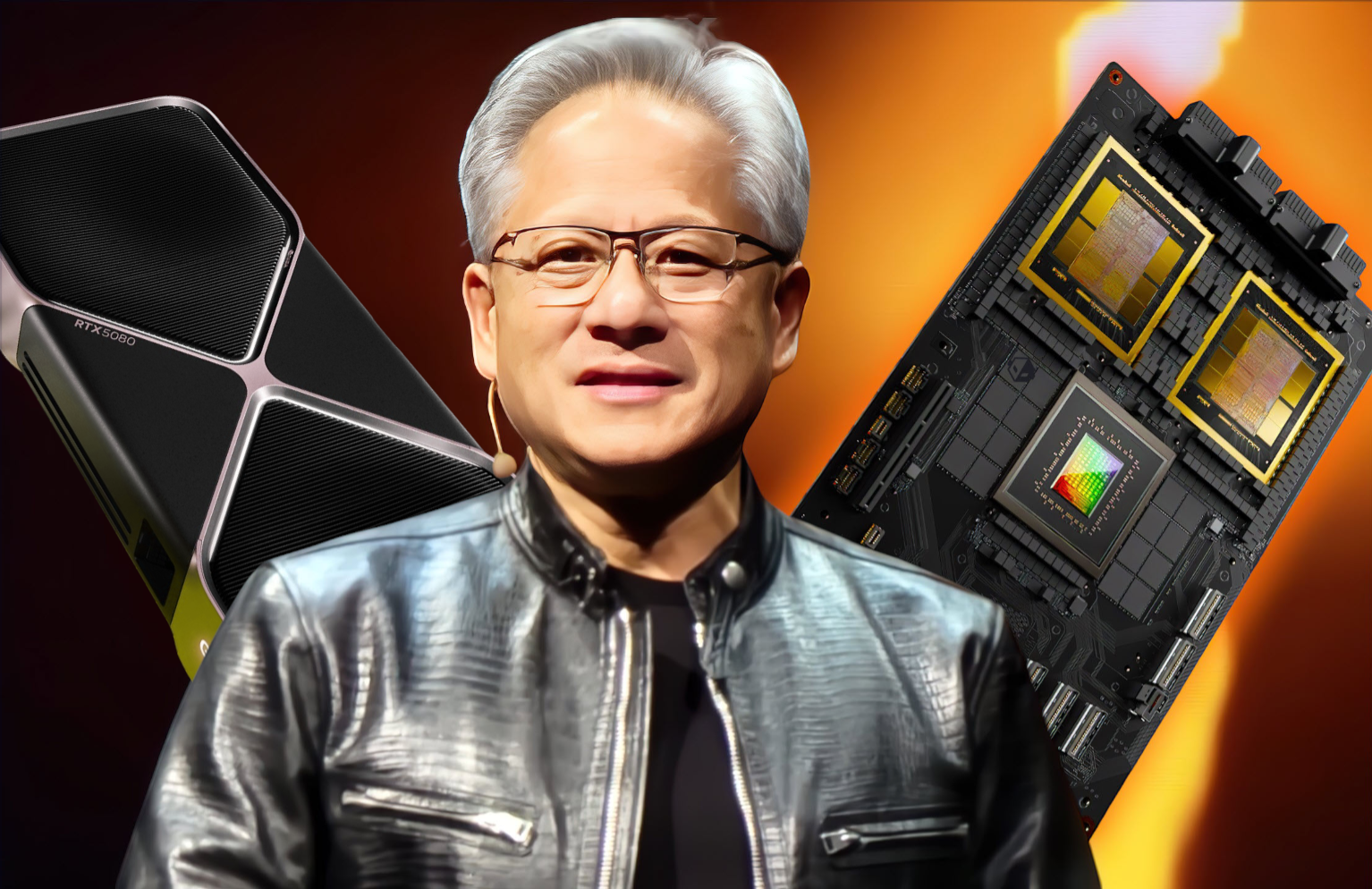

The Blackwell architecture represents NVIDIA’s latest and most ambitious GPU design, initially shipped in sample form last year before entering its record-breaking production ramp. A GB300 system is composed of 72 next-generation Blackwell GPUs paired with 36 Arm-based CPUs, an arrangement that positions it as the most advanced AI infrastructure currently available to enterprises. During its ramp, NVIDIA had to refine the production mask – a technical process that optimizes chip yields – to ensure volumes could meet skyrocketing demand. That adjustment paid off quickly, with Blackwell contributing billions in revenue in its very first quarters on the market.

By Q2 FY2026, NVIDIA reported that Blackwell already accounted for roughly half of its data center revenues, with sequential growth of 17% in just one quarter. Importantly, the architecture has not been confined to AI-specific workloads alone. NVIDIA noted that its gaming and professional visualization businesses also benefited from the technology, thanks to Blackwell’s versatility across compute-intensive tasks. The introduction of the Blackwell Ultra GPU further broadened its product portfolio, signaling NVIDIA’s intent to dominate across both consumer and enterprise markets.

Looking ahead, US brokerage houses now believe that shipments of the GB200 and GB300 rack systems could climb 300% sequentially in Q3, and potentially hit 60,000 units next year. To put this into perspective, earlier forecasts suggested that Microsoft alone could order around 1,500 GB200 racks by Q4 2025. If broader enterprise adoption accelerates at the predicted pace, NVIDIA may be on track to cement an even stronger monopoly on high-end AI infrastructure.

Foxconn, the Taiwanese electronics giant also known as Hon Hai Technology Group, plays a crucial role here as one of NVIDIA’s primary contract manufacturers for these Blackwell racks. Analysts argue that Foxconn stands to benefit enormously from this AI boom, as its assembly lines become integral to meeting demand from cloud providers, research institutions, and governments rushing to secure next-generation compute capacity.

Still, optimism comes with caveats. Investors and critics alike note the subtle difference between “expected to grow” and “can grow,” reflecting the uncertainty of supply chain pressures and global geopolitical risks. Some skeptics point to NVIDIA’s strategic focus on AI GPUs as a deliberate slowdown in traditional graphics card production, sparking frustration among gamers. Others raise concerns – half-joking, half-serious – about hidden backdoors in chips or the potential for catastrophic global events to disrupt the entire tech ecosystem. Whether these fears are grounded or exaggerated, they highlight just how central NVIDIA’s hardware has become, not only to AI development but to the broader conversation around technology, economics, and even global security.

1 comment

U notice all the ‘insiders’ pumpin nvidia stock while media drops hit pieces? whole thing feels rigged ngl