Intel’s internal battle over whether to spin off its foundry division echoes a pivotal moment in tech history – AMD’s 2008 decision to go fabless. Back then, AMD was sinking under mounting losses, delayed product launches, and manufacturing setbacks. Its quad-core Opteron and Phenom CPUs both missed launch windows, eroding market share while Intel surged ahead. With no sign of manufacturing breakthroughs and billions lost, AMD sold its foundry arm to Mubadala Investment Company, birthing GlobalFoundries. The deal brought $700 million in cash, $1.1 billion in debt relief, and the freedom to use leading fabs like TSMC.

The trade-off? AMD gave up its stake too soon and missed out on billions as GF’s value soared – but it regained competitiveness and produced some of its best processors ever.

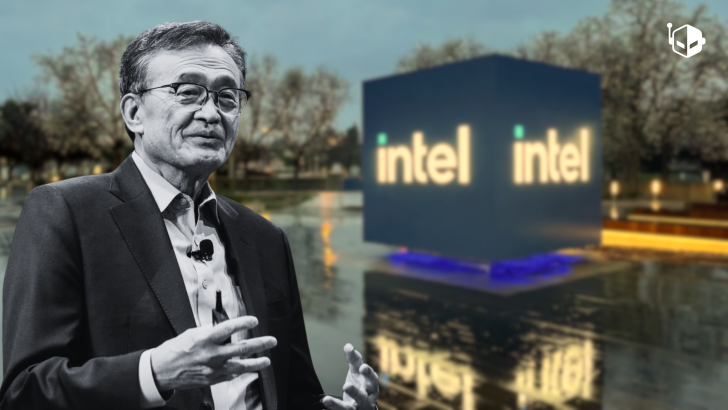

Today, Intel faces its own crisis: an estimated $13 billion in 2024 foundry losses, about 10% of its market cap. Political pressures and shareholder impatience are mounting, with some pushing for a spin-off or a U.S.-backed consortium to keep domestic chipmaking alive. CEO Lip-Bu Tan resists, citing progress toward advanced nodes like 18A and 14A – key to U.S. semiconductor dominance. Intel has poured tens of billions into R&D, and Tan fears a spin-off now could derail years of work just as 18A approaches a critical 70% yield target for profitability.

Supporters of a spin-off see faster cash flow and competitive products if Intel taps external foundries, much like AMD did. Opponents warn that losing direct control over manufacturing risks weakening the company’s technology edge and national security leverage. In the meantime, Intel is cutting costs through layoffs and project cancellations, hoping to stabilize while refining 18A to challenge TSMC’s N2. Whether Intel follows AMD’s path or holds the line, the decision will shape not just its future, but America’s chip industry for decades.