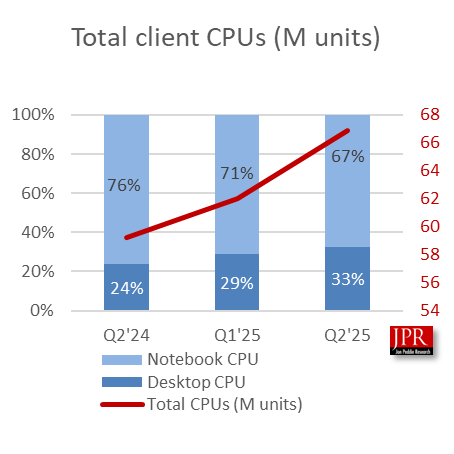

The global CPU market is showing signs of growth in 2025, thanks in part to uncertainty surrounding upcoming tariffs. Client CPU shipments saw a notable 7.9% increase from the first to the second quarter of the year, a marked deviation from the usual flat growth in the first half of the year. This rise is likely due to panic buying as hardware manufacturers rushed to import as much as possible before the tariff freeze ended in April.

Fortunately, most electronics, including semiconductors and PCs, were exempt from the tariffs, but the uncertainty it caused was enough to boost CPU and PC shipments.

Jon Peddie Research, in its latest report, highlights that this unexpected uptick in client CPU shipments was heavily influenced by the looming tariffs

. The tariffs, particularly those announced by the Trump administration, played a key role in accelerating the market’s growth. However, the impact is expected to continue influencing the market well into the future.

On the server side, CPU shipments grew by a modest 0.6% quarter-over-quarter and 22% year-over-year, signaling steady progress in the server market. Intel remains the dominant player with a 73% market share, though AMD has been gaining ground, increasing its share to 27%, up from around 19% last year. AMD’s strong performance across both client and server segments reflects its focus on superior performance. As the demand for CPUs continues to rise, AMD’s role in the market is expected to grow.

However, the recently announced 100% tariffs on chips could disrupt both Intel and AMD. Intel’s U.S.-based fabs will likely be exempt from the tariffs, giving the company an advantage. AMD, still reliant on TSMC in Taiwan for its chip production, may face challenges if the tariffs are applied to its CPUs. This could potentially drive up prices, reducing AMD’s market competitiveness unless the company invests in building its own U.S.-based manufacturing capabilities.

2 comments

Didn’t WTFtech have an article recently claiming that aMD caught Shintel in server?

Total market share of Intel vs AMD server is about 70/30, but AMD is gaining more sell through each quarter, now around 40%+ as more customers transition from Xeon powered to Epyc powered racks. It will take some time to match intel in overall share since as soon as 2017 AMD basically had zero presence in the market